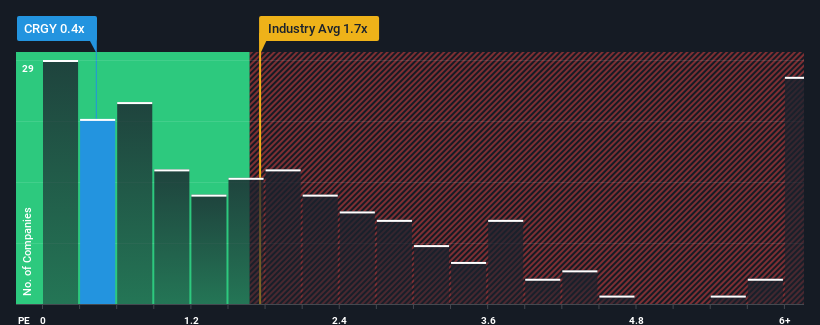

When close to half the companies operating in the Oil and Gas industry in the United States have price-to-sales ratios (or "P/S") above 1.7x, you may consider Crescent Energy Company (NYSE:CRGY) as an attractive investment with its 0.4x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

How Has Crescent Energy Performed Recently?

Crescent Energy's negative revenue growth of late has neither been better nor worse than most other companies. Perhaps the market is expecting future revenue performance to deteriorate further, which has kept the P/S suppressed. You'd much rather the company continue improving its revenue if you still believe in the business. In saying that, existing shareholders may feel hopeful about the share price if the company's revenue continues tracking the industry.

Want the full picture on analyst estimates for the company? Then our free report on Crescent Energy will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Crescent Energy's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 15%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 219% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 15%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 219% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 2.9% per annum during the coming three years according to the six analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 2.8% per annum, which is not materially different.

In light of this, it's peculiar that Crescent Energy's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What Does Crescent Energy's P/S Mean For Investors?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It looks to us like the P/S figures for Crescent Energy remain low despite growth that is expected to be in line with other companies in the industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

Before you settle on your opinion, we've discovered 5 warning signs for Crescent Energy (1 doesn't sit too well with us!) that you should be aware of.

If these risks are making you reconsider your opinion on Crescent Energy, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.