Ideally, your overall portfolio should beat the market average. But even the best stock picker will only win with some selections. So we wouldn't blame long term Want Want China Holdings Limited (HKG:151) shareholders for doubting their decision to hold, with the stock down 30% over a half decade.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

While the share price declined over five years, Want Want China Holdings actually managed to increase EPS by an average of 3.1% per year. So it doesn't seem like EPS is a great guide to understanding how the market is valuing the stock. Alternatively, growth expectations may have been unreasonable in the past.

While the share price declined over five years, Want Want China Holdings actually managed to increase EPS by an average of 3.1% per year. So it doesn't seem like EPS is a great guide to understanding how the market is valuing the stock. Alternatively, growth expectations may have been unreasonable in the past.

By glancing at these numbers, we'd posit that the the market had expectations of much higher growth, five years ago. Looking to other metrics might better explain the share price change.

In contrast to the share price, revenue has actually increased by 3.7% a year in the five year period. A more detailed examination of the revenue and earnings may or may not explain why the share price languishes; there could be an opportunity.

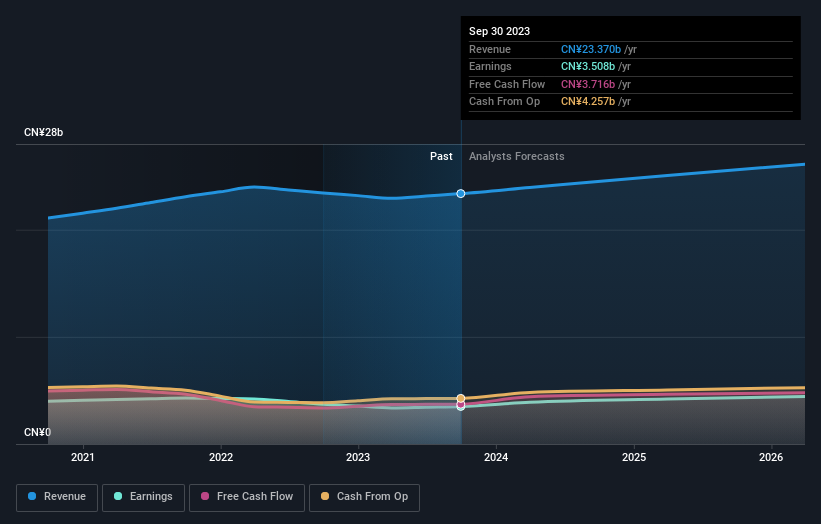

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Want Want China Holdings is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So it makes a lot of sense to check out what analysts think Want Want China Holdings will earn in the future (free analyst consensus estimates)

A Dividend Lost

The value of past dividends are accounted for in the total shareholder return (TSR), but not in the share price return mentioned above. Many would argue the TSR gives a more complete picture of the value a stock brings to its holders. Over the last 5 years, Want Want China Holdings generated a TSR of -10%, which is, of course, better than the share price return. Even though the company isn't paying dividends at the moment, it has done in the past.

A Different Perspective

Want Want China Holdings shareholders are down 11% over twelve months, which isn't far from the market return of -10%. Unfortunately, last year's performance is a deterioration of an already poor long term track record, given the loss of 2% per year over the last five years. It will probably take a substantial improvement in the fundamental performance for the company to reverse this trend. Before forming an opinion on Want Want China Holdings you might want to consider these 3 valuation metrics.

But note: Want Want China Holdings may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.