The vacant Los Angeles office building in the US will be demolished just to build 30 new electric vehicle charging stations. US real estate investors shouted: “Absolutely crazy!”

Demand for US office buildings is weak due to factors such as the spread of remote work models due to the pandemic.

According to data from Real Capital Analytics, office property prices across the country have dropped by about 20% from their peak. Barry Sternlicht, Chairman and CEO of Starwood Capital, said: “The office market is now facing an existential crisis... assets worth $3 trillion may now be worth only $1.8 trillion.”

In the face of oversupply and falling demand in the market, the demolition of old office buildings has become a trend. Faced with a large empty plot left behind after demolition, developers began exploring new uses for the old office space, such as transforming it into a tennis court or electric vehicle charging station.

In the face of oversupply and falling demand in the market, the demolition of old office buildings has become a trend. Faced with a large empty plot left behind after demolition, developers began exploring new uses for the old office space, such as transforming it into a tennis court or electric vehicle charging station.

Analysts pointed out that this is an innovative approach. By building more charging facilities, it can provide convenience for electric vehicle users while promoting the development of clean energy and green transportation. This shift is likely to become an increasingly common trend in urban planning and commercial real estate development in the future.

“Dismantling” becomes the preferred option

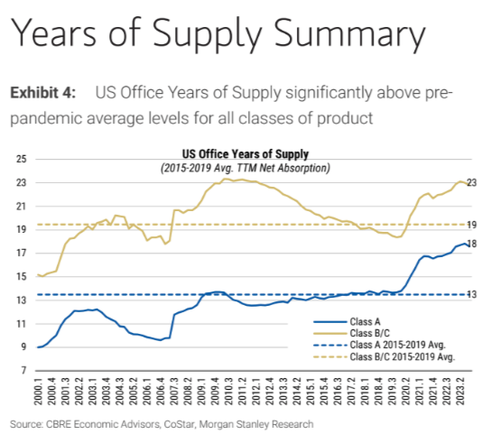

Morgan Stanley pointed out in a report that there is already an oversupply of US office buildings, and the supply of offices is already far higher than the pre-pandemic average.

Kyle Bass, founder of Hayman Capital Management (Hayman Capital Management), pointed out last year that demand for commercial real estate was weak after the pandemic, so much so that office buildings had to be demolished. He also mentioned that while converting office buildings to residential apartments is a potential solution in theory to ease the pressure on urban housing, it may not be feasible in practice.

In an interview with the media, Bass said:

“Simply improving or refurbishing an existing office building will not solve the underlying problem. Instead, decisive steps are needed to dismantle some of the surplus office buildings to fundamentally reset the market to meet the challenge of falling long-term demand.”

Office buildings become charging piles

In the face of oversupply and falling demand in the market, the demolition of old office buildings has become a trend. However, many developers and city planners were troubled by large sections of empty land left behind after the demolition.

Analysts believe, firstly, that it is not possible to build a new office building. In this poor market environment, even if old buildings are demolished and new buildings are rebuilt, no one will rent them because there is already a large amount of underutilized office space in the market.

As a result, developers began exploring new uses for old office space, such as transforming the old office space into tennis courts, electric vehicle charging stations, etc.

Vornado Realty Trust, a major real estate investment trust, planned to build a 61-story office building near Madison Square Garden after demolishing the Pennsylvania Hotel in recent months. However, as the commercial real estate market declined, particularly demand for office buildings, the construction work was suspended.

Faced with uncertainty about the construction project, Vornado proposed a creative temporary solution to convert the site that had already been demolished from the hotel into a tennis court for events such as the US Open.

Another example is a recent report from real estate company CoStar that a 68,000 square foot office building in Los Angeles may be used to build 30 electric vehicle charging stations after being demolished.

Analysts pointed out that converting old office building plots into electric vehicle charging stations is an innovative solution. By providing more charging facilities for electric vehicles, it can increase the attractiveness of the city, provide convenience for electric vehicle users, promote the development of clean energy and green transportation, and promote the city's economic development. This shift is likely to become an increasingly common trend in urban planning and commercial real estate development in the future.

面对市场上的供应过剩和需求下降,拆除老旧办公楼成为趋势。面对拆除后留下的大块空白地块,开发商开始探索老旧办公空间的新用途,例如改造成网球场、电动汽车充电站等。

面对市场上的供应过剩和需求下降,拆除老旧办公楼成为趋势。面对拆除后留下的大块空白地块,开发商开始探索老旧办公空间的新用途,例如改造成网球场、电动汽车充电站等。