When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose your money. But on the bright side, you can make far more than 100% on a really good stock. One great example is Zhejiang Huatie Emergency Equipment Science & Technology Co.,Ltd. (SHSE:603300) which saw its share price drive 217% higher over five years. In the last week the share price is up 4.9%.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

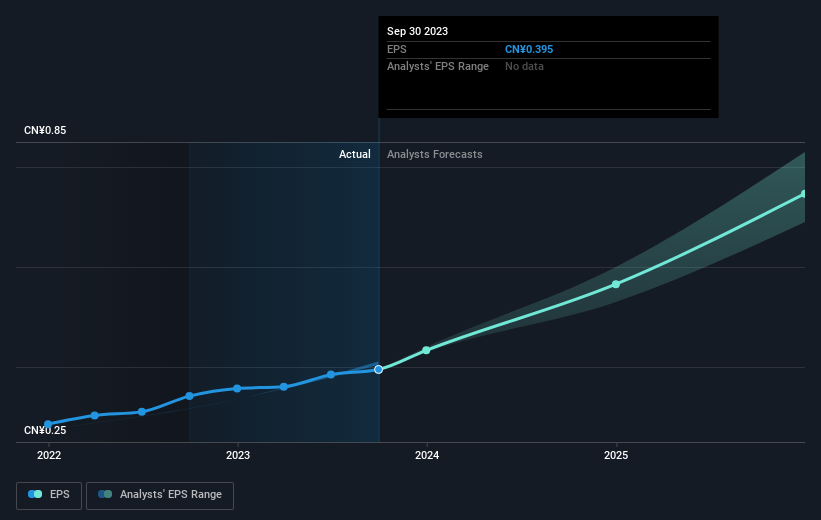

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, Zhejiang Huatie Emergency Equipment Science & TechnologyLtd achieved compound earnings per share (EPS) growth of 44% per year. This EPS growth is higher than the 26% average annual increase in the share price. So one could conclude that the broader market has become more cautious towards the stock.

During five years of share price growth, Zhejiang Huatie Emergency Equipment Science & TechnologyLtd achieved compound earnings per share (EPS) growth of 44% per year. This EPS growth is higher than the 26% average annual increase in the share price. So one could conclude that the broader market has become more cautious towards the stock.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that Zhejiang Huatie Emergency Equipment Science & TechnologyLtd has improved its bottom line over the last three years, but what does the future have in store? This free interactive report on Zhejiang Huatie Emergency Equipment Science & TechnologyLtd's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About The Total Shareholder Return (TSR)?

We've already covered Zhejiang Huatie Emergency Equipment Science & TechnologyLtd's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Zhejiang Huatie Emergency Equipment Science & TechnologyLtd's TSR of 221% for the 5 years exceeded its share price return, because it has paid dividends.

A Different Perspective

It's good to see that Zhejiang Huatie Emergency Equipment Science & TechnologyLtd has rewarded shareholders with a total shareholder return of 11% in the last twelve months. Having said that, the five-year TSR of 26% a year, is even better. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 2 warning signs for Zhejiang Huatie Emergency Equipment Science & TechnologyLtd that you should be aware of.

We will like Zhejiang Huatie Emergency Equipment Science & TechnologyLtd better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.