While Jinlong Machinery & Electronic Co.,Ltd (SZSE:300032) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 23% in the last quarter. But that doesn't change the fact that the returns over the last five years have been pleasing. Its return of 30% has certainly bested the market return!

Since it's been a strong week for Jinlong Machinery & ElectronicLtd shareholders, let's have a look at trend of the longer term fundamentals.

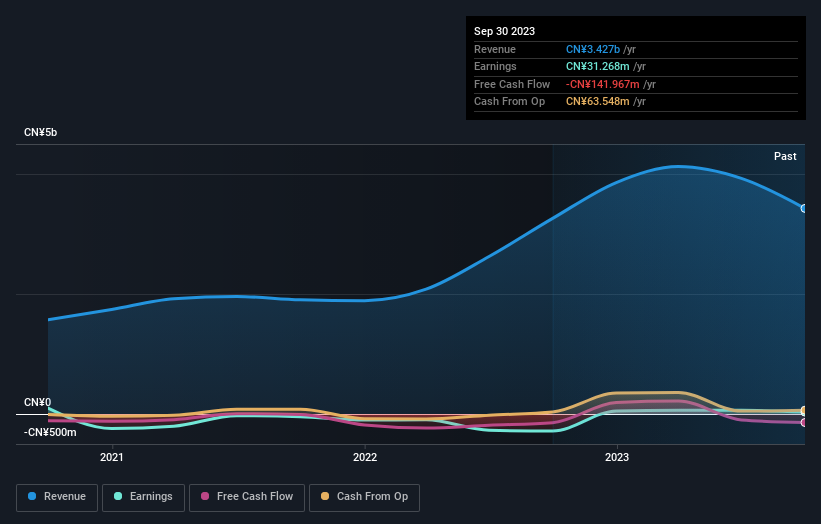

Given that Jinlong Machinery & ElectronicLtd only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

For the last half decade, Jinlong Machinery & ElectronicLtd can boast revenue growth at a rate of 7.4% per year. That's a pretty good long term growth rate. Revenue has been growing at a reasonable clip, so it's debatable whether the share price growth of 5% full reflects the underlying business growth. The key question is whether revenue growth will slow down, and if so, how quickly. Lack of earnings means you have to project further into the future justify the valuation on the basis of future free cash flow.

For the last half decade, Jinlong Machinery & ElectronicLtd can boast revenue growth at a rate of 7.4% per year. That's a pretty good long term growth rate. Revenue has been growing at a reasonable clip, so it's debatable whether the share price growth of 5% full reflects the underlying business growth. The key question is whether revenue growth will slow down, and if so, how quickly. Lack of earnings means you have to project further into the future justify the valuation on the basis of future free cash flow.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Jinlong Machinery & ElectronicLtd's financial health with this free report on its balance sheet.

A Different Perspective

While it's never nice to take a loss, Jinlong Machinery & ElectronicLtd shareholders can take comfort that their trailing twelve month loss of 15% wasn't as bad as the market loss of around 17%. Of course, the long term returns are far more important and the good news is that over five years, the stock has returned 5% for each year. In the best case scenario the last year is just a temporary blip on the journey to a brighter future. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for Jinlong Machinery & ElectronicLtd (of which 1 is concerning!) you should know about.

But note: Jinlong Machinery & ElectronicLtd may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.