Sinopep-Allsino Bio Pharmaceutical Co.,Ltd. (SHSE:688076) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 62% in the last year.

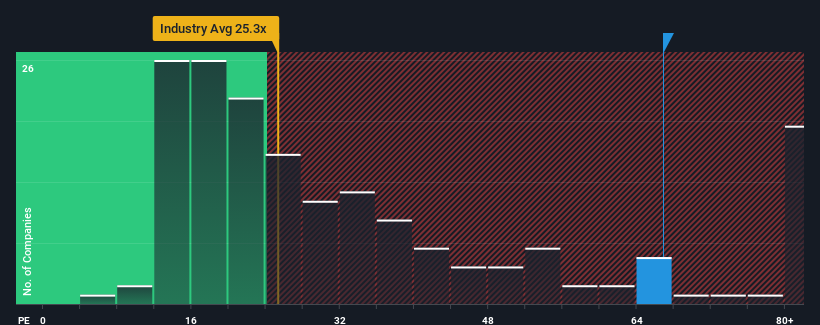

Since its price has surged higher, Sinopep-Allsino Bio PharmaceuticalLtd may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 66.9x, since almost half of all companies in China have P/E ratios under 28x and even P/E's lower than 17x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Sinopep-Allsino Bio PharmaceuticalLtd certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

How Is Sinopep-Allsino Bio PharmaceuticalLtd's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as steep as Sinopep-Allsino Bio PharmaceuticalLtd's is when the company's growth is on track to outshine the market decidedly.

The only time you'd be truly comfortable seeing a P/E as steep as Sinopep-Allsino Bio PharmaceuticalLtd's is when the company's growth is on track to outshine the market decidedly.

Taking a look back first, we see that the company grew earnings per share by an impressive 25% last year. Still, incredibly EPS has fallen 1.7% in total from three years ago, which is quite disappointing. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 24% as estimated by the two analysts watching the company. That's shaping up to be materially lower than the 41% growth forecast for the broader market.

In light of this, it's alarming that Sinopep-Allsino Bio PharmaceuticalLtd's P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Final Word

The strong share price surge has got Sinopep-Allsino Bio PharmaceuticalLtd's P/E rushing to great heights as well. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Sinopep-Allsino Bio PharmaceuticalLtd's analyst forecasts revealed that its inferior earnings outlook isn't impacting its high P/E anywhere near as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Sinopep-Allsino Bio PharmaceuticalLtd with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of Sinopep-Allsino Bio PharmaceuticalLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.