Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Everdisplay Optronics (Shanghai) Co., Ltd. (SHSE:688538) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

What Is Everdisplay Optronics (Shanghai)'s Net Debt?

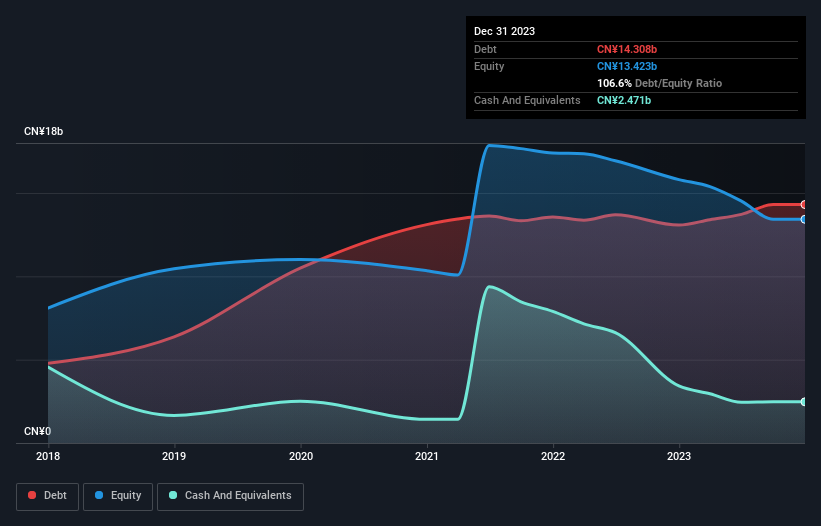

You can click the graphic below for the historical numbers, but it shows that as of September 2023 Everdisplay Optronics (Shanghai) had CN¥14.3b of debt, an increase on CN¥13.1b, over one year. However, it does have CN¥2.47b in cash offsetting this, leading to net debt of about CN¥11.8b.

How Healthy Is Everdisplay Optronics (Shanghai)'s Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Everdisplay Optronics (Shanghai) had liabilities of CN¥2.58b due within 12 months and liabilities of CN¥13.1b due beyond that. Offsetting these obligations, it had cash of CN¥2.47b as well as receivables valued at CN¥245.4m due within 12 months. So its liabilities total CN¥13.0b more than the combination of its cash and short-term receivables.

Zooming in on the latest balance sheet data, we can see that Everdisplay Optronics (Shanghai) had liabilities of CN¥2.58b due within 12 months and liabilities of CN¥13.1b due beyond that. Offsetting these obligations, it had cash of CN¥2.47b as well as receivables valued at CN¥245.4m due within 12 months. So its liabilities total CN¥13.0b more than the combination of its cash and short-term receivables.

This deficit isn't so bad because Everdisplay Optronics (Shanghai) is worth CN¥33.1b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk. There's no doubt that we learn most about debt from the balance sheet. But it is Everdisplay Optronics (Shanghai)'s earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Everdisplay Optronics (Shanghai) had a loss before interest and tax, and actually shrunk its revenue by 27%, to CN¥3.0b. That makes us nervous, to say the least.

Caveat Emptor

While Everdisplay Optronics (Shanghai)'s falling revenue is about as heartwarming as a wet blanket, arguably its earnings before interest and tax (EBIT) loss is even less appealing. To be specific the EBIT loss came in at CN¥3.2b. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. Another cause for caution is that is bled CN¥2.6b in negative free cash flow over the last twelve months. So suffice it to say we consider the stock very risky. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example - Everdisplay Optronics (Shanghai) has 2 warning signs we think you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.