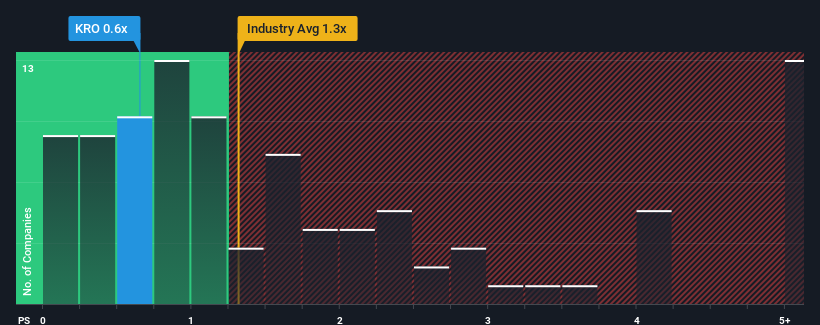

When you see that almost half of the companies in the Chemicals industry in the United States have price-to-sales ratios (or "P/S") above 1.3x, Kronos Worldwide, Inc. (NYSE:KRO) looks to be giving off some buy signals with its 0.6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

What Does Kronos Worldwide's Recent Performance Look Like?

Recent times haven't been great for Kronos Worldwide as its revenue has been falling quicker than most other companies. It seems that many are expecting the dismal revenue performance to persist, which has repressed the P/S. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the revenue slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Kronos Worldwide.How Is Kronos Worldwide's Revenue Growth Trending?

In order to justify its P/S ratio, Kronos Worldwide would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 23%. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 23%. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next year should generate growth of 18% as estimated by the two analysts watching the company. That's shaping up to be materially higher than the 6.5% growth forecast for the broader industry.

In light of this, it's peculiar that Kronos Worldwide's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What Does Kronos Worldwide's P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

To us, it seems Kronos Worldwide currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

You always need to take note of risks, for example - Kronos Worldwide has 2 warning signs we think you should be aware of.

If these risks are making you reconsider your opinion on Kronos Worldwide, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.