Shannon Semiconductor Technology Co.,Ltd. (SZSE:300475) shareholders are no doubt pleased to see that the share price has bounced 37% in the last month, although it is still struggling to make up recently lost ground. Looking back a bit further, it's encouraging to see the stock is up 86% in the last year.

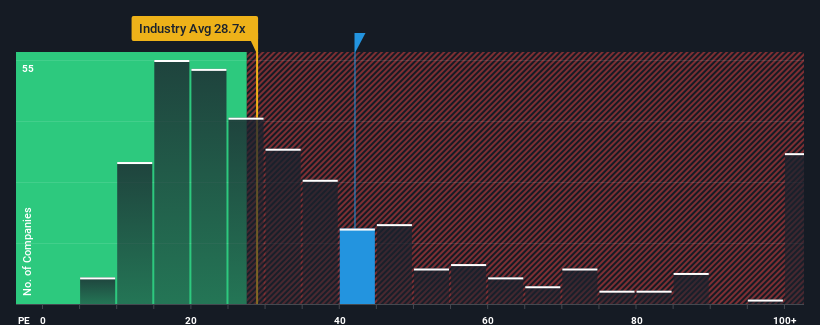

Since its price has surged higher, given around half the companies in China have price-to-earnings ratios (or "P/E's") below 29x, you may consider Shannon Semiconductor TechnologyLtd as a stock to potentially avoid with its 42x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Recent times have been pleasing for Shannon Semiconductor TechnologyLtd as its earnings have risen in spite of the market's earnings going into reverse. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors' willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Is There Enough Growth For Shannon Semiconductor TechnologyLtd?

There's an inherent assumption that a company should outperform the market for P/E ratios like Shannon Semiconductor TechnologyLtd's to be considered reasonable.

There's an inherent assumption that a company should outperform the market for P/E ratios like Shannon Semiconductor TechnologyLtd's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 49%. Pleasingly, EPS has also lifted 578% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next year should bring diminished returns, with earnings decreasing 4.3% as estimated by the sole analyst watching the company. With the market predicted to deliver 41% growth , that's a disappointing outcome.

With this information, we find it concerning that Shannon Semiconductor TechnologyLtd is trading at a P/E higher than the market. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh heavily on the share price eventually.

What We Can Learn From Shannon Semiconductor TechnologyLtd's P/E?

Shannon Semiconductor TechnologyLtd's P/E is getting right up there since its shares have risen strongly. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Shannon Semiconductor TechnologyLtd's analyst forecasts revealed that its outlook for shrinking earnings isn't impacting its high P/E anywhere near as much as we would have predicted. When we see a poor outlook with earnings heading backwards, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Before you take the next step, you should know about the 4 warning signs for Shannon Semiconductor TechnologyLtd (1 shouldn't be ignored!) that we have uncovered.

If you're unsure about the strength of Shannon Semiconductor TechnologyLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.