Yunnan Lincang Xinyuan Germanium Industry Co.,LTD (SZSE:002428) shareholders are no doubt pleased to see that the share price has bounced 28% in the last month, although it is still struggling to make up recently lost ground. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

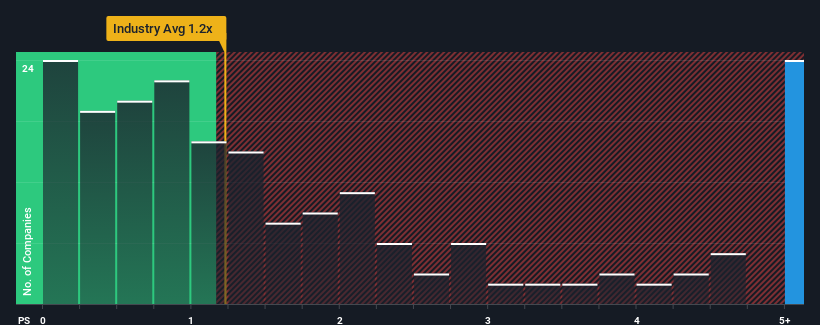

Since its price has surged higher, given around half the companies in China's Metals and Mining industry have price-to-sales ratios (or "P/S") below 1.2x, you may consider Yunnan Lincang Xinyuan Germanium IndustryLTD as a stock to avoid entirely with its 12.2x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

What Does Yunnan Lincang Xinyuan Germanium IndustryLTD's P/S Mean For Shareholders?

Yunnan Lincang Xinyuan Germanium IndustryLTD could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Yunnan Lincang Xinyuan Germanium IndustryLTD will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Yunnan Lincang Xinyuan Germanium IndustryLTD's to be considered reasonable.

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Yunnan Lincang Xinyuan Germanium IndustryLTD's to be considered reasonable.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. That's essentially a continuation of what we've seen over the last three years, as its revenue growth has been virtually non-existent for that entire period. So it seems apparent to us that the company has struggled to grow revenue meaningfully over that time.

Turning to the outlook, the next year should generate growth of 25% as estimated by the only analyst watching the company. Meanwhile, the rest of the industry is forecast to only expand by 15%, which is noticeably less attractive.

In light of this, it's understandable that Yunnan Lincang Xinyuan Germanium IndustryLTD's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Shares in Yunnan Lincang Xinyuan Germanium IndustryLTD have seen a strong upwards swing lately, which has really helped boost its P/S figure. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Yunnan Lincang Xinyuan Germanium IndustryLTD maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Metals and Mining industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Yunnan Lincang Xinyuan Germanium IndustryLTD with six simple checks on some of these key factors.

If these risks are making you reconsider your opinion on Yunnan Lincang Xinyuan Germanium IndustryLTD, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.