Nantong Jianghai Capacitor Co. Ltd. (SZSE:002484) shares have had a really impressive month, gaining 28% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 26% over that time.

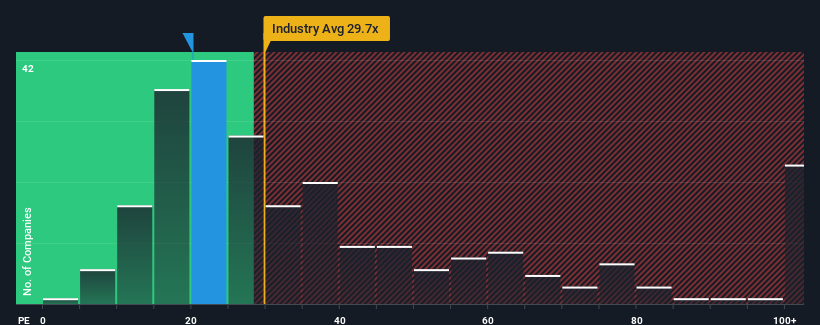

Even after such a large jump in price, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 31x, you may still consider Nantong Jianghai Capacitor as an attractive investment with its 20.1x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Nantong Jianghai Capacitor has been doing quite well of late. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Nantong Jianghai Capacitor's to be considered reasonable.

There's an inherent assumption that a company should underperform the market for P/E ratios like Nantong Jianghai Capacitor's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 20% last year. The strong recent performance means it was also able to grow EPS by 139% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 27% as estimated by the nine analysts watching the company. With the market predicted to deliver 41% growth , the company is positioned for a weaker earnings result.

In light of this, it's understandable that Nantong Jianghai Capacitor's P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From Nantong Jianghai Capacitor's P/E?

The latest share price surge wasn't enough to lift Nantong Jianghai Capacitor's P/E close to the market median. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Nantong Jianghai Capacitor's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you settle on your opinion, we've discovered 1 warning sign for Nantong Jianghai Capacitor that you should be aware of.

If you're unsure about the strength of Nantong Jianghai Capacitor's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.