Those holding Jadard Technology Inc. (SHSE:688252) shares would be relieved that the share price has rebounded 27% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 21% over that time.

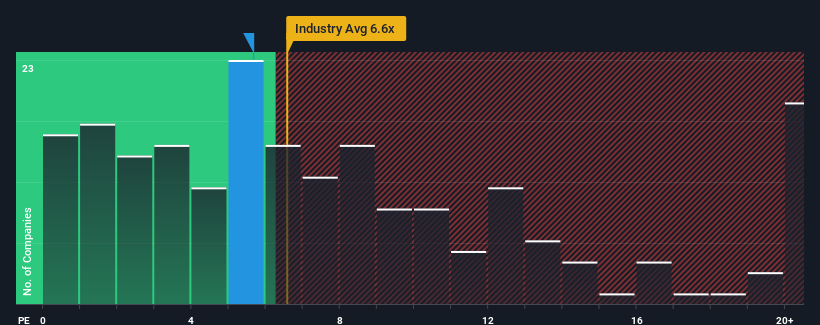

Although its price has surged higher, it's still not a stretch to say that Jadard Technology's price-to-sales (or "P/S") ratio of 5.7x right now seems quite "middle-of-the-road" compared to the Semiconductor industry in China, where the median P/S ratio is around 6.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

What Does Jadard Technology's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Jadard Technology's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Jadard Technology's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Jadard Technology?

Jadard Technology's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Jadard Technology's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 15%. Even so, admirably revenue has lifted 93% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Looking ahead now, revenue is anticipated to climb by 28% during the coming year according to the lone analyst following the company. With the industry predicted to deliver 20,706% growth, the company is positioned for a weaker revenue result.

In light of this, it's curious that Jadard Technology's P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Jadard Technology's P/S Mean For Investors?

Jadard Technology appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

When you consider that Jadard Technology's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. A positive change is needed in order to justify the current price-to-sales ratio.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Jadard Technology, and understanding should be part of your investment process.

If you're unsure about the strength of Jadard Technology's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.