Those holding Chengdu M&S Electronics Technology Co.,Ltd. (SHSE:688311) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 39% in the last twelve months.

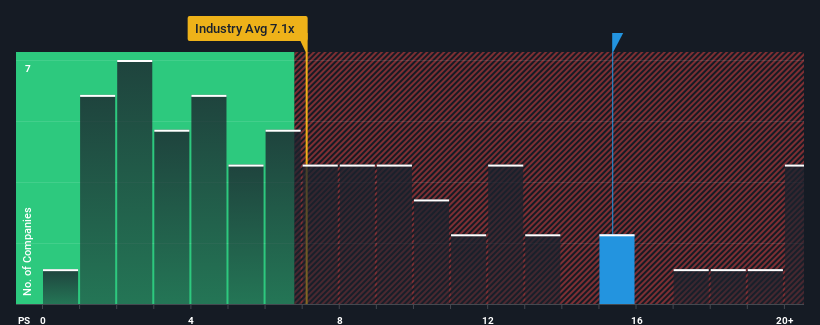

Following the firm bounce in price, Chengdu M&S Electronics TechnologyLtd's price-to-sales (or "P/S") ratio of 15.3x might make it look like a strong sell right now compared to other companies in the Aerospace & Defense industry in China, where around half of the companies have P/S ratios below 7.1x and even P/S below 3x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

What Does Chengdu M&S Electronics TechnologyLtd's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Chengdu M&S Electronics TechnologyLtd's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Chengdu M&S Electronics TechnologyLtd.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Chengdu M&S Electronics TechnologyLtd would need to produce outstanding growth that's well in excess of the industry.

In order to justify its P/S ratio, Chengdu M&S Electronics TechnologyLtd would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a frustrating 30% decrease to the company's top line. As a result, revenue from three years ago have also fallen 21% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 261% during the coming year according to the dual analysts following the company. That's shaping up to be materially higher than the 48% growth forecast for the broader industry.

With this information, we can see why Chengdu M&S Electronics TechnologyLtd is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Chengdu M&S Electronics TechnologyLtd's P/S?

Shares in Chengdu M&S Electronics TechnologyLtd have seen a strong upwards swing lately, which has really helped boost its P/S figure. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Chengdu M&S Electronics TechnologyLtd maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Aerospace & Defense industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 1 warning sign for Chengdu M&S Electronics TechnologyLtd you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.