Shandong Wit Dyne Health Co.,Ltd. (SZSE:000915) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 21% over that time.

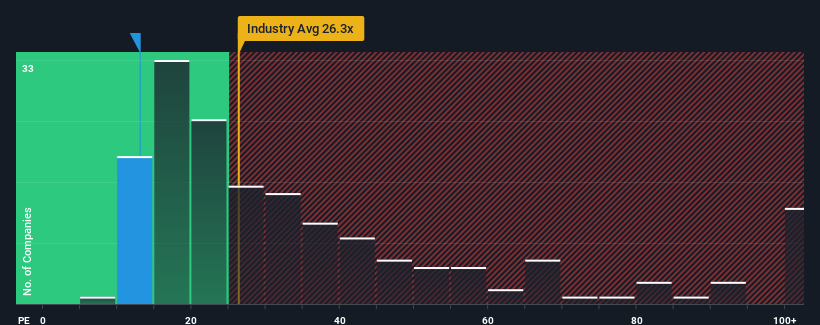

Although its price has surged higher, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 31x, you may still consider Shandong Wit Dyne HealthLtd as a highly attractive investment with its 13x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Shandong Wit Dyne HealthLtd has been doing quite well of late. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

How Is Shandong Wit Dyne HealthLtd's Growth Trending?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Shandong Wit Dyne HealthLtd's to be considered reasonable.

There's an inherent assumption that a company should far underperform the market for P/E ratios like Shandong Wit Dyne HealthLtd's to be considered reasonable.

Retrospectively, the last year delivered a decent 11% gain to the company's bottom line. This was backed up an excellent period prior to see EPS up by 101% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 15% as estimated by the two analysts watching the company. That's shaping up to be materially lower than the 42% growth forecast for the broader market.

In light of this, it's understandable that Shandong Wit Dyne HealthLtd's P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Shandong Wit Dyne HealthLtd's P/E

Shandong Wit Dyne HealthLtd's recent share price jump still sees its P/E sitting firmly flat on the ground. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Shandong Wit Dyne HealthLtd's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Shandong Wit Dyne HealthLtd with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of Shandong Wit Dyne HealthLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.