Chinese electric vehicle startup NIO, Inc (NYSE: NIO) reported fourth-quarter revenue of 17.10 billion yuan ($2.41 billion), up by 6.5% year-over-year and down by 10.3% from the previous quarter. Analysts, on average, estimated revenue of $2.29 billion for the quarter.

Excluding share-based compensation expenses, the company reported an adjusted loss of (2.81) yuan or ($0.39) compared to (3.07) yuan in the year-ago quarter and (2.28) yuan in the third quarter of 2023. Analysts had called for a loss of $(0.51) per share.

Vehicle deliveries were 50,045 in the quarter, up by 25% Y/Y and down by 9.7% Q/Q. Consequently, vehicle revenue climbed 4.6% Y/Y and down by 11.3% Q/Q.

Gross margin for the quarter expanded to 7.5%, up from the year ago's 3.9% and down from the previous quarter's 8.0%, as vehicle margin expanded from 6.8% a year ago to 11.9%.

Gross margin for the quarter expanded to 7.5%, up from the year ago's 3.9% and down from the previous quarter's 8.0%, as vehicle margin expanded from 6.8% a year ago to 11.9%.

Cash and cash equivalents, restricted cash, short-term investment, and long-term time deposits were 57.3 billion yuan ($8.1 billion) as of December 31, 2023.

William Bin Li, founder, Chair and CEO of NIO, "At NIO Day 2023, we unveiled ET9, our smart electric executive flagship, showcasing a suite of our latest technologies, including our self-developed AD chip, full-domain 900V architecture, advanced intelligent chassis system and various other industry-leading innovations."

"We will soon start deliveries of 2024 NIO products equipped with the highest computing power among production vehicles and constantly enhance users' driving and digital experience. Meanwhile, we plan to release Navigate on Pilot Plus (NOP+) for urban roads to all NT2.0 users in the second quarter."

NIO's Forward Outlook: The company guided deliveries of 31,000 – 33,000 units for the first quarter, or (0.1)% – 6.3% Y/Y.

The company expects first quarter revenue of $1.48 billion – $1.56 billion, representing (1.7)% – 3.8% Y/Y growth and below the consensus of $2.28 billion.

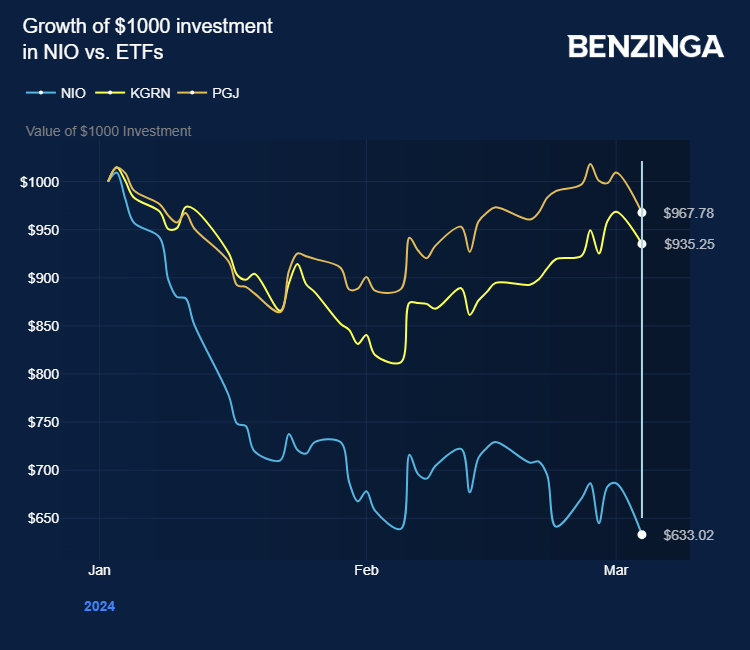

Investors can gain exposure to NIO via KraneShares MSCI China Clean Technology Index ETF (NYSE:KGRN) and Invesco Golden Dragon China ETF (NASDAQ:PGJ).

Price Action: NIO shares traded lower by 0.94% at $5.28 premarket on the last check Tuesday.

Photo by T. Schneider on Shutterstock