Jointo Energy Investment Co., Ltd. Hebei (SZSE:000600) shareholders should be happy to see the share price up 13% in the last month. But over the last half decade, the stock has not performed well. In fact, the share price is down 28%, which falls well short of the return you could get by buying an index fund.

On a more encouraging note the company has added CN¥376m to its market cap in just the last 7 days, so let's see if we can determine what's driven the five-year loss for shareholders.

While Jointo Energy Investment Hebei made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last half decade, Jointo Energy Investment Hebei saw its revenue increase by 6.5% per year. That's a pretty good rate for a long time period. Shareholders have seen the share price fall at 5% per year, for five years: a poor performance. Clearly, the expectations from back then have not been satisfied. There is always a big risk of losing money yourself when you buy shares in a company that loses money.

In the last half decade, Jointo Energy Investment Hebei saw its revenue increase by 6.5% per year. That's a pretty good rate for a long time period. Shareholders have seen the share price fall at 5% per year, for five years: a poor performance. Clearly, the expectations from back then have not been satisfied. There is always a big risk of losing money yourself when you buy shares in a company that loses money.

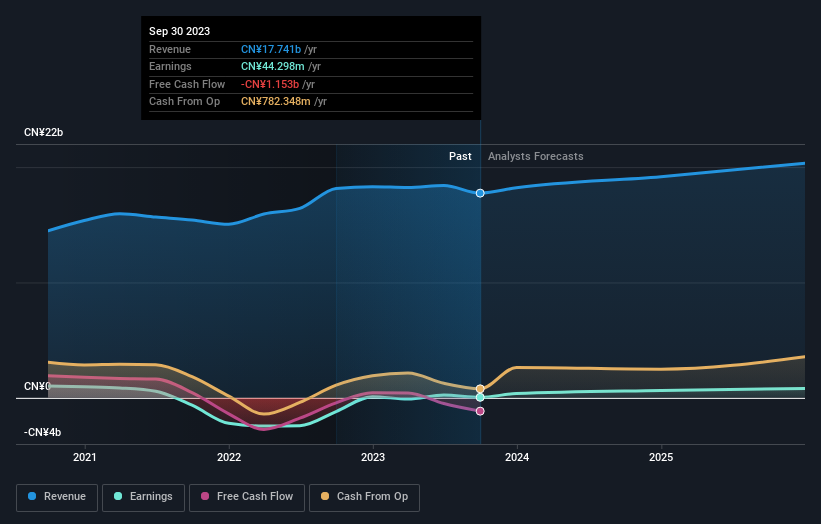

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We know that Jointo Energy Investment Hebei has improved its bottom line lately, but what does the future have in store? You can see what analysts are predicting for Jointo Energy Investment Hebei in this interactive graph of future profit estimates.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Jointo Energy Investment Hebei's TSR for the last 5 years was -23%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

While it's certainly disappointing to see that Jointo Energy Investment Hebei shares lost 11% throughout the year, that wasn't as bad as the market loss of 16%. Given the total loss of 4% per year over five years, it seems returns have deteriorated in the last twelve months. Whilst Baron Rothschild does tell the investor "buy when there's blood in the streets, even if the blood is your own", buyers would need to examine the data carefully to be comfortable that the business itself is sound. It's always interesting to track share price performance over the longer term. But to understand Jointo Energy Investment Hebei better, we need to consider many other factors. For example, we've discovered 2 warning signs for Jointo Energy Investment Hebei (1 is potentially serious!) that you should be aware of before investing here.

Of course Jointo Energy Investment Hebei may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.