Enanta Pharmaceuticals, Inc. (NASDAQ:ENTA) shares have continued their recent momentum with a 27% gain in the last month alone. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 67% share price drop in the last twelve months.

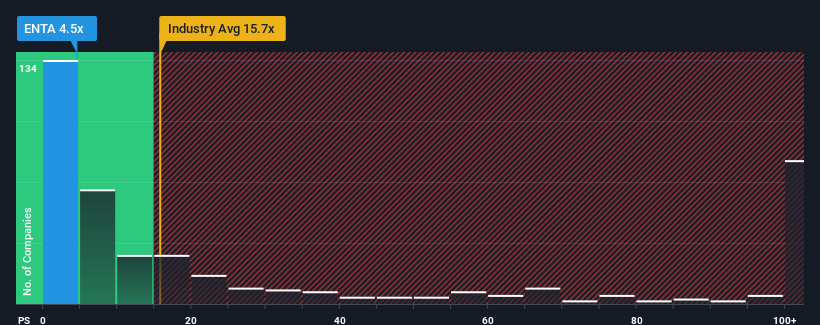

In spite of the firm bounce in price, Enanta Pharmaceuticals' price-to-sales (or "P/S") ratio of 4.5x might still make it look like a strong buy right now compared to the wider Biotechs industry in the United States, where around half of the companies have P/S ratios above 15.7x and even P/S above 76x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

NasdaqGS:ENTA Price to Sales Ratio vs Industry March 5th 2024

How Has Enanta Pharmaceuticals Performed Recently?

While the industry has experienced revenue growth lately, Enanta Pharmaceuticals' revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

While the industry has experienced revenue growth lately, Enanta Pharmaceuticals' revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Enanta Pharmaceuticals' future stacks up against the industry? In that case, our free report is a great place to start.

Is There Any Revenue Growth Forecasted For Enanta Pharmaceuticals?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Enanta Pharmaceuticals' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 10% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 28% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 0.6% each year as estimated by the eight analysts watching the company. With the industry predicted to deliver 265% growth each year, that's a disappointing outcome.

With this in consideration, we find it intriguing that Enanta Pharmaceuticals' P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Key Takeaway

Enanta Pharmaceuticals' recent share price jump still sees fails to bring its P/S alongside the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It's clear to see that Enanta Pharmaceuticals maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Enanta Pharmaceuticals that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.