HC SemiTek Corporation (SZSE:300323) shareholders are no doubt pleased to see that the share price has bounced 29% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 33% over that time.

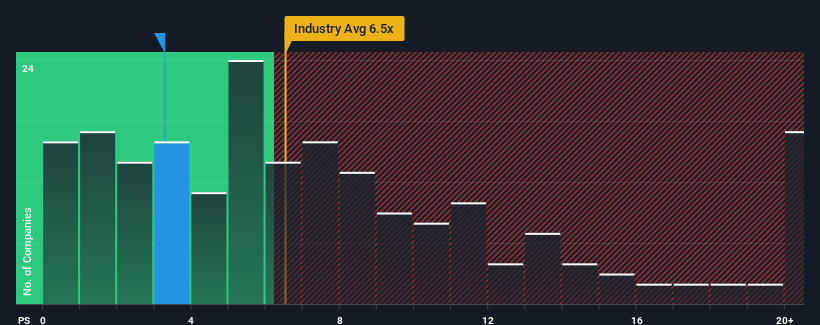

Although its price has surged higher, HC SemiTek may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 3.3x, since almost half of all companies in the Semiconductor industry in China have P/S ratios greater than 6.5x and even P/S higher than 12x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

How HC SemiTek Has Been Performing

It looks like revenue growth has deserted HC SemiTek recently, which is not something to boast about. It might be that many expect the uninspiring revenue performance to worsen, which has repressed the P/S. If not, then existing shareholders may be feeling optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on HC SemiTek's earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, HC SemiTek would need to produce sluggish growth that's trailing the industry.

In order to justify its P/S ratio, HC SemiTek would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. The longer-term trend has been no better as the company has no revenue growth to show for over the last three years either. Accordingly, shareholders probably wouldn't have been satisfied with the complete absence of medium-term growth.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 37% shows it's noticeably less attractive.

With this in consideration, it's easy to understand why HC SemiTek's P/S falls short of the mark set by its industry peers. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Final Word

Despite HC SemiTek's share price climbing recently, its P/S still lags most other companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

In line with expectations, HC SemiTek maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 1 warning sign for HC SemiTek that you need to take into consideration.

If these risks are making you reconsider your opinion on HC SemiTek, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.