Those holding Ningxia Orient Tantalum Industry Co., Ltd. (SZSE:000962) shares would be relieved that the share price has rebounded 30% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 13% over that time.

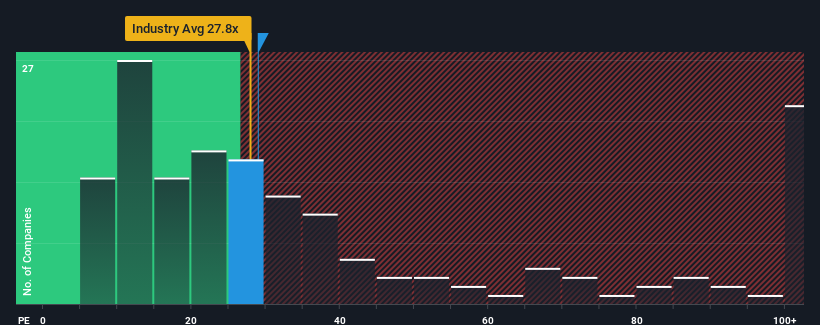

Even after such a large jump in price, there still wouldn't be many who think Ningxia Orient Tantalum Industry's price-to-earnings (or "P/E") ratio of 28.9x is worth a mention when the median P/E in China is similar at about 30x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Ningxia Orient Tantalum Industry has been doing quite well of late. It might be that many expect the strong earnings performance to deteriorate like the rest, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Does Growth Match The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Ningxia Orient Tantalum Industry's to be considered reasonable.

There's an inherent assumption that a company should be matching the market for P/E ratios like Ningxia Orient Tantalum Industry's to be considered reasonable.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 4.9% last year. Pleasingly, EPS has also lifted 227% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 21% as estimated by the one analyst watching the company. With the market predicted to deliver 41% growth , the company is positioned for a weaker earnings result.

With this information, we find it interesting that Ningxia Orient Tantalum Industry is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Final Word

Ningxia Orient Tantalum Industry appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Ningxia Orient Tantalum Industry currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Ningxia Orient Tantalum Industry that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.