Those holding Wuxi Taiji Industry Limited Corporation (SHSE:600667) shares would be relieved that the share price has rebounded 33% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Taking a wider view, although not as strong as the last month, the full year gain of 12% is also fairly reasonable.

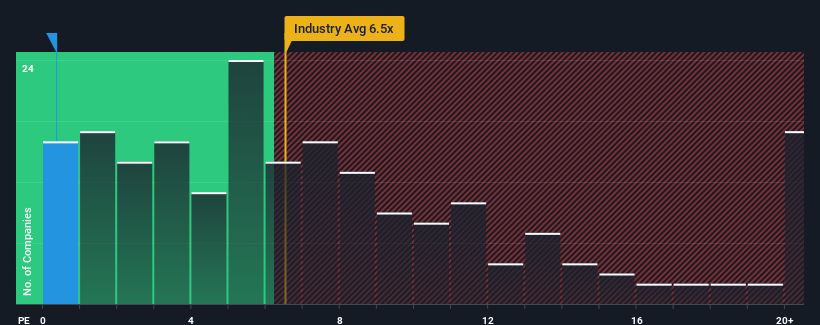

Even after such a large jump in price, Wuxi Taiji Industry Limited's price-to-sales (or "P/S") ratio of 0.4x might still make it look like a strong buy right now compared to the wider Semiconductor industry in China, where around half of the companies have P/S ratios above 6.5x and even P/S above 12x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

How Has Wuxi Taiji Industry Limited Performed Recently?

Recent revenue growth for Wuxi Taiji Industry Limited has been in line with the industry. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Wuxi Taiji Industry Limited will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as depressed as Wuxi Taiji Industry Limited's is when the company's growth is on track to lag the industry decidedly.

The only time you'd be truly comfortable seeing a P/S as depressed as Wuxi Taiji Industry Limited's is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered an exceptional 20% gain to the company's top line. Pleasingly, revenue has also lifted 123% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 25% over the next year. With the industry predicted to deliver 37% growth, the company is positioned for a weaker revenue result.

With this information, we can see why Wuxi Taiji Industry Limited is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Wuxi Taiji Industry Limited's P/S?

Shares in Wuxi Taiji Industry Limited have risen appreciably however, its P/S is still subdued. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Wuxi Taiji Industry Limited maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Wuxi Taiji Industry Limited with six simple checks.

If you're unsure about the strength of Wuxi Taiji Industry Limited's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.