MLOptic Corp. (SHSE:688502) shareholders are no doubt pleased to see that the share price has bounced 38% in the last month, although it is still struggling to make up recently lost ground. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

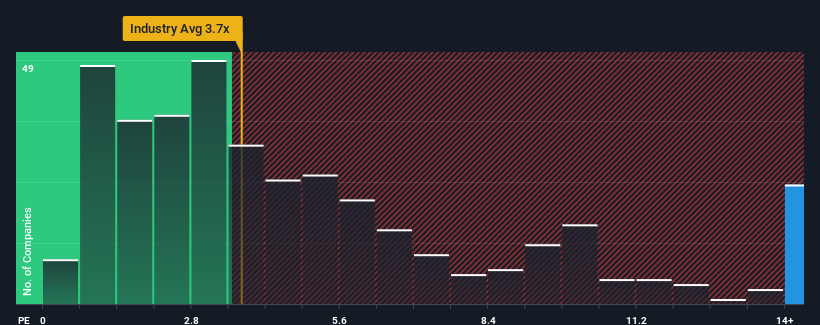

Following the firm bounce in price, when almost half of the companies in China's Electronic industry have price-to-sales ratios (or "P/S") below 3.7x, you may consider MLOptic as a stock not worth researching with its 14.7x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

What Does MLOptic's P/S Mean For Shareholders?

MLOptic's revenue growth of late has been pretty similar to most other companies. Perhaps the market is expecting future revenue performance to improve, justifying the currently elevated P/S. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on MLOptic.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, MLOptic would need to produce outstanding growth that's well in excess of the industry.

In order to justify its P/S ratio, MLOptic would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 3.5% last year. The latest three year period has also seen an excellent 84% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Turning to the outlook, the next year should generate growth of 37% as estimated by the only analyst watching the company. That's shaping up to be materially higher than the 25% growth forecast for the broader industry.

With this information, we can see why MLOptic is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Shares in MLOptic have seen a strong upwards swing lately, which has really helped boost its P/S figure. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that MLOptic maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Electronic industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with MLOptic, and understanding should be part of your investment process.

If these risks are making you reconsider your opinion on MLOptic, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.