Those holding Jiangsu Shuangxing Color Plastic New Materials Co., Ltd. (SZSE:002585) shares would be relieved that the share price has rebounded 27% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 52% share price drop in the last twelve months.

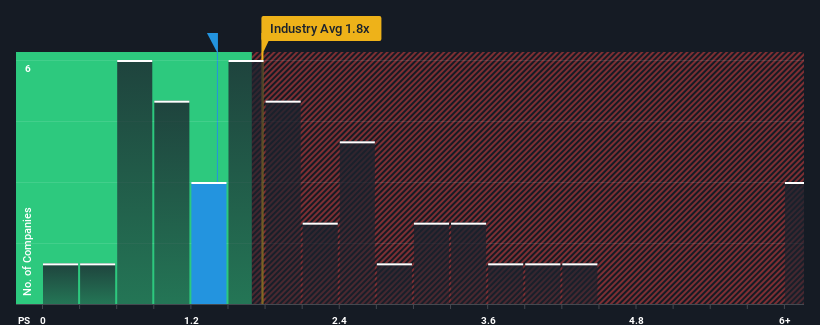

Although its price has surged higher, there still wouldn't be many who think Jiangsu Shuangxing Color Plastic New Materials' price-to-sales (or "P/S") ratio of 1.4x is worth a mention when the median P/S in China's Packaging industry is similar at about 1.8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

How Has Jiangsu Shuangxing Color Plastic New Materials Performed Recently?

Recent times haven't been great for Jiangsu Shuangxing Color Plastic New Materials as its revenue has been falling quicker than most other companies. Perhaps the market is expecting future revenue performance to begin matching the rest of the industry, which has kept the P/S from declining. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Jiangsu Shuangxing Color Plastic New Materials will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Jiangsu Shuangxing Color Plastic New Materials would need to produce growth that's similar to the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 21%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 9.8% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Turning to the outlook, the next year should generate growth of 21% as estimated by the two analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 21%, which is not materially different.

With this information, we can see why Jiangsu Shuangxing Color Plastic New Materials is trading at a fairly similar P/S to the industry. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Bottom Line On Jiangsu Shuangxing Color Plastic New Materials' P/S

Jiangsu Shuangxing Color Plastic New Materials appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've seen that Jiangsu Shuangxing Color Plastic New Materials maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Jiangsu Shuangxing Color Plastic New Materials, and understanding should be part of your investment process.

If these risks are making you reconsider your opinion on Jiangsu Shuangxing Color Plastic New Materials, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.