Those holding Ningbo Donly Co.,Ltd (SZSE:002164) shares would be relieved that the share price has rebounded 30% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 24% in the last twelve months.

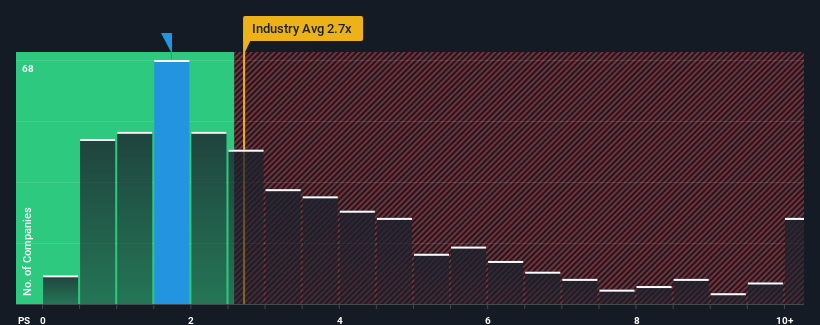

In spite of the firm bounce in price, Ningbo DonlyLtd may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 1.7x, considering almost half of all companies in the Machinery industry in China have P/S ratios greater than 2.7x and even P/S higher than 5x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

What Does Ningbo DonlyLtd's Recent Performance Look Like?

We'd have to say that with no tangible growth over the last year, Ningbo DonlyLtd's revenue has been unimpressive. Perhaps the market believes the recent lacklustre revenue performance is a sign of future underperformance relative to industry peers, hurting the P/S. Those who are bullish on Ningbo DonlyLtd will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Ningbo DonlyLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Ningbo DonlyLtd?

The only time you'd be truly comfortable seeing a P/S as low as Ningbo DonlyLtd's is when the company's growth is on track to lag the industry.

The only time you'd be truly comfortable seeing a P/S as low as Ningbo DonlyLtd's is when the company's growth is on track to lag the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. However, a few strong years before that means that it was still able to grow revenue by an impressive 31% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been great for the company, but investors will want to ask why it has slowed to such an extent.

Comparing that to the industry, which is predicted to deliver 27% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this information, we can see why Ningbo DonlyLtd is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

The Final Word

Ningbo DonlyLtd's stock price has surged recently, but its but its P/S still remains modest. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Ningbo DonlyLtd confirms that the company's revenue trends over the past three-year years are a key factor in its low price-to-sales ratio, as we suspected, given they fall short of current industry expectations. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

Before you take the next step, you should know about the 1 warning sign for Ningbo DonlyLtd that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.