3onedata Co., Ltd. (SHSE:688618) shareholders are no doubt pleased to see that the share price has bounced 31% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 36% over that time.

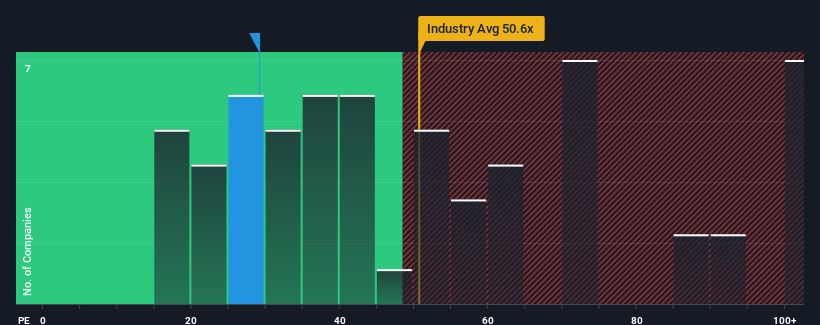

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about 3onedata's P/E ratio of 29.1x, since the median price-to-earnings (or "P/E") ratio in China is also close to 30x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

3onedata certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It might be that many expect the strong earnings performance to deteriorate like the rest, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Is There Some Growth For 3onedata?

In order to justify its P/E ratio, 3onedata would need to produce growth that's similar to the market.

In order to justify its P/E ratio, 3onedata would need to produce growth that's similar to the market.

If we review the last year of earnings growth, the company posted a terrific increase of 15%. The latest three year period has also seen a 29% overall rise in EPS, aided extensively by its short-term performance. Therefore, it's fair to say the earnings growth recently has been respectable for the company.

Looking ahead now, EPS is anticipated to climb by 61% during the coming year according to the three analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 41%, which is noticeably less attractive.

In light of this, it's curious that 3onedata's P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

3onedata appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of 3onedata's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for 3onedata that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.