Those holding Telink Semiconductor(Shanghai)Co.,Ltd. (SHSE:688591) shares would be relieved that the share price has rebounded 31% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

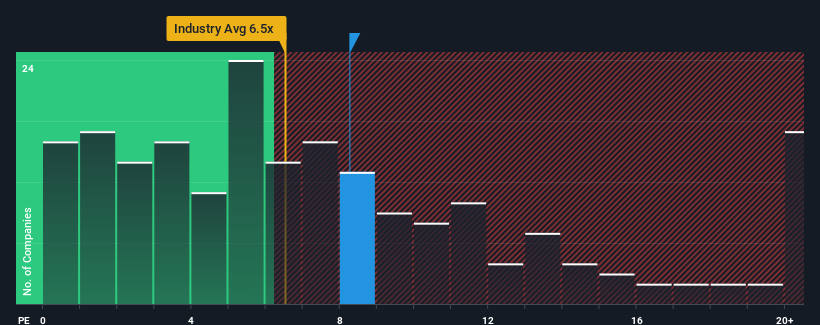

After such a large jump in price, Telink Semiconductor(Shanghai)Co.Ltd's price-to-sales (or "P/S") ratio of 8.3x might make it look like a sell right now compared to the wider Semiconductor industry in China, where around half of the companies have P/S ratios below 6.5x and even P/S below 3x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

What Does Telink Semiconductor(Shanghai)Co.Ltd's Recent Performance Look Like?

Telink Semiconductor(Shanghai)Co.Ltd has been doing a decent job lately as it's been growing revenue at a reasonable pace. One possibility is that the P/S ratio is high because investors think this good revenue growth will be enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Telink Semiconductor(Shanghai)Co.Ltd will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Telink Semiconductor(Shanghai)Co.Ltd's to be considered reasonable.

Retrospectively, the last year delivered a decent 4.4% gain to the company's revenues. The latest three year period has also seen an excellent 40% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

This is in contrast to the rest of the industry, which is expected to grow by 37% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it concerning that Telink Semiconductor(Shanghai)Co.Ltd is trading at a P/S higher than the industry. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Key Takeaway

Telink Semiconductor(Shanghai)Co.Ltd shares have taken a big step in a northerly direction, but its P/S is elevated as a result. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

The fact that Telink Semiconductor(Shanghai)Co.Ltd currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. When we see slower than industry revenue growth but an elevated P/S, there's considerable risk of the share price declining, sending the P/S lower. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Telink Semiconductor(Shanghai)Co.Ltd with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of Telink Semiconductor(Shanghai)Co.Ltd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.