Those holding Jilin University Zhengyuan Information Technologies Co., Ltd. (SZSE:003029) shares would be relieved that the share price has rebounded 30% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 54% share price drop in the last twelve months.

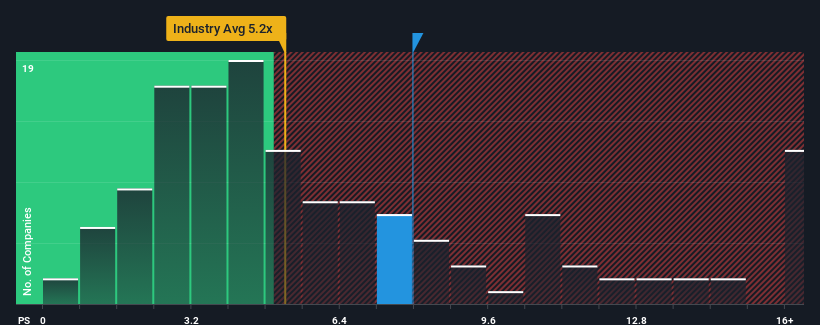

Since its price has surged higher, when almost half of the companies in China's Software industry have price-to-sales ratios (or "P/S") below 5.2x, you may consider Jilin University Zhengyuan Information Technologies as a stock not worth researching with its 8x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

What Does Jilin University Zhengyuan Information Technologies' Recent Performance Look Like?

While the industry has experienced revenue growth lately, Jilin University Zhengyuan Information Technologies' revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Jilin University Zhengyuan Information Technologies' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Jilin University Zhengyuan Information Technologies would need to produce outstanding growth that's well in excess of the industry.

In order to justify its P/S ratio, Jilin University Zhengyuan Information Technologies would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 68%. The last three years don't look nice either as the company has shrunk revenue by 32% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 190% during the coming year according to the only analyst following the company. That's shaping up to be materially higher than the 33% growth forecast for the broader industry.

In light of this, it's understandable that Jilin University Zhengyuan Information Technologies' P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Jilin University Zhengyuan Information Technologies' P/S has grown nicely over the last month thanks to a handy boost in the share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Jilin University Zhengyuan Information Technologies maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Software industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 2 warning signs for Jilin University Zhengyuan Information Technologies (1 is concerning!) that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.