Jointo Energy Investment Co., Ltd. Hebei (SZSE:000600) shareholders are no doubt pleased to see that the share price has bounced 28% in the last month, although it is still struggling to make up recently lost ground. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 9.0% over the last year.

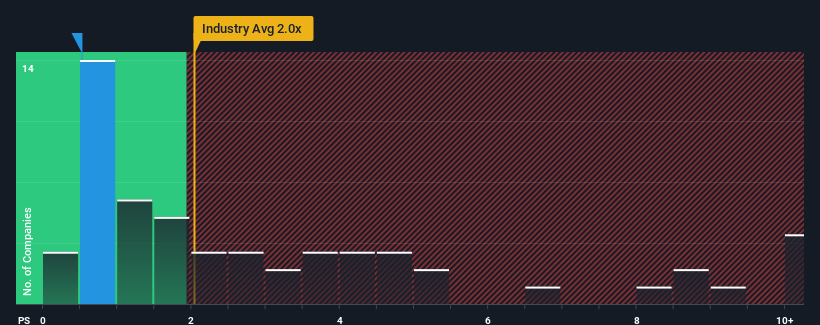

In spite of the firm bounce in price, Jointo Energy Investment Hebei may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.5x, since almost half of all companies in the Renewable Energy industry in China have P/S ratios greater than 2x and even P/S higher than 5x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

How Jointo Energy Investment Hebei Has Been Performing

Jointo Energy Investment Hebei could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Jointo Energy Investment Hebei's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as Jointo Energy Investment Hebei's is when the company's growth is on track to lag the industry.

The only time you'd be truly comfortable seeing a P/S as low as Jointo Energy Investment Hebei's is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 2.2%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 23% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 6.7% as estimated by the three analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 11%, which is noticeably more attractive.

With this in consideration, its clear as to why Jointo Energy Investment Hebei's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

The latest share price surge wasn't enough to lift Jointo Energy Investment Hebei's P/S close to the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Jointo Energy Investment Hebei's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Plus, you should also learn about these 2 warning signs we've spotted with Jointo Energy Investment Hebei (including 1 which is significant).

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.