Those holding Zhejiang Wazam New Materials Co.,LTD. (SHSE:603186) shares would be relieved that the share price has rebounded 29% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 29% in the last twelve months.

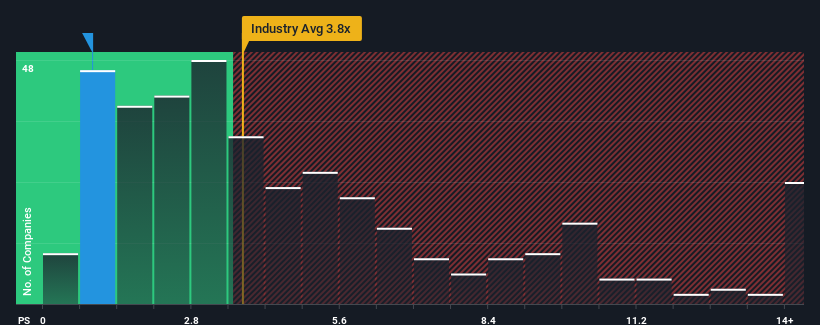

Even after such a large jump in price, Zhejiang Wazam New MaterialsLTD may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.9x, considering almost half of all companies in the Electronic industry in China have P/S ratios greater than 3.8x and even P/S higher than 7x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

What Does Zhejiang Wazam New MaterialsLTD's P/S Mean For Shareholders?

There hasn't been much to differentiate Zhejiang Wazam New MaterialsLTD's and the industry's revenue growth lately. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. Those who are bullish on Zhejiang Wazam New MaterialsLTD will be hoping that this isn't the case.

Want the full picture on analyst estimates for the company? Then our free report on Zhejiang Wazam New MaterialsLTD will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Zhejiang Wazam New MaterialsLTD?

In order to justify its P/S ratio, Zhejiang Wazam New MaterialsLTD would need to produce anemic growth that's substantially trailing the industry.

In order to justify its P/S ratio, Zhejiang Wazam New MaterialsLTD would need to produce anemic growth that's substantially trailing the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 2.6%. The latest three year period has also seen an excellent 62% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Turning to the outlook, the next year should generate growth of 43% as estimated by the dual analysts watching the company. With the industry only predicted to deliver 25%, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Zhejiang Wazam New MaterialsLTD's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On Zhejiang Wazam New MaterialsLTD's P/S

Even after such a strong price move, Zhejiang Wazam New MaterialsLTD's P/S still trails the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

To us, it seems Zhejiang Wazam New MaterialsLTD currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

You should always think about risks. Case in point, we've spotted 2 warning signs for Zhejiang Wazam New MaterialsLTD you should be aware of, and 1 of them is a bit unpleasant.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.