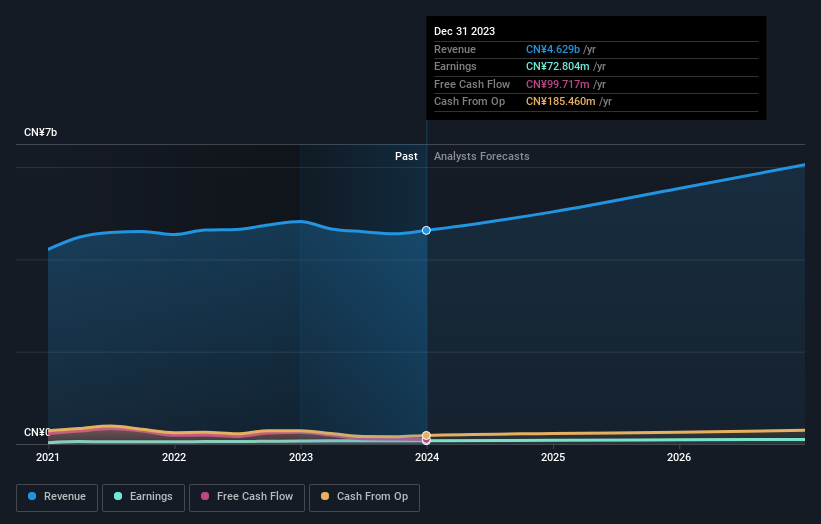

Ruitai Materials Technology Co., Ltd. (SZSE:002066) last week reported its latest yearly results, which makes it a good time for investors to dive in and see if the business is performing in line with expectations. Revenues came in 6.7% below expectations, at CN¥4.6b. Statutory earnings per share were relatively better off, with a per-share profit of CN¥0.32 being roughly in line with analyst estimates. This is an important time for investors, as they can track a company's performance in its report, look at what expert is forecasting for next year, and see if there has been any change to expectations for the business. So we gathered the latest post-earnings forecasts to see what estimate suggests is in store for next year.

After the latest results, the one analyst covering Ruitai Materials Technology are now predicting revenues of CN¥5.03b in 2024. If met, this would reflect a decent 8.7% improvement in revenue compared to the last 12 months. Per-share earnings are expected to swell 11% to CN¥0.35. In the lead-up to this report, the analyst had been modelling revenues of CN¥5.72b and earnings per share (EPS) of CN¥0.43 in 2024. Indeed, we can see that the analyst is a lot more bearish about Ruitai Materials Technology's prospects following the latest results, administering a real cut to revenue estimates and slashing their EPS estimates to boot.

The consensus price target fell 29% to CN¥8.70, with the weaker earnings outlook clearly leading valuation estimates.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Ruitai Materials Technology's past performance and to peers in the same industry. The analyst is definitely expecting Ruitai Materials Technology's growth to accelerate, with the forecast 8.7% annualised growth to the end of 2024 ranking favourably alongside historical growth of 5.0% per annum over the past five years. Compare this with other companies in the same industry, which are forecast to see revenue growth of 12% annually. It seems obvious that, while the future growth outlook is brighter than the recent past, Ruitai Materials Technology is expected to grow slower than the wider industry.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Ruitai Materials Technology's past performance and to peers in the same industry. The analyst is definitely expecting Ruitai Materials Technology's growth to accelerate, with the forecast 8.7% annualised growth to the end of 2024 ranking favourably alongside historical growth of 5.0% per annum over the past five years. Compare this with other companies in the same industry, which are forecast to see revenue growth of 12% annually. It seems obvious that, while the future growth outlook is brighter than the recent past, Ruitai Materials Technology is expected to grow slower than the wider industry.

The Bottom Line

The most important thing to take away is that the analyst downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following these results. Unfortunately, they also downgraded their revenue estimates, and our data indicates underperformance compared to the wider industry. Even so, earnings per share are more important to the intrinsic value of the business. The consensus price target fell measurably, with the analyst seemingly not reassured by the latest results, leading to a lower estimate of Ruitai Materials Technology's future valuation.

With that in mind, we wouldn't be too quick to come to a conclusion on Ruitai Materials Technology. Long-term earnings power is much more important than next year's profits. At least one analyst has provided forecasts out to 2026, which can be seen for free on our platform here.

And what about risks? Every company has them, and we've spotted 2 warning signs for Ruitai Materials Technology (of which 1 is potentially serious!) you should know about.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.