As every investor would know, not every swing hits the sweet spot. But really bad investments should be rare. So take a moment to sympathize with the long term shareholders of China Resources Building Materials Technology Holdings Limited (HKG:1313), who have seen the share price tank a massive 86% over a three year period. That'd be enough to cause even the strongest minds some disquiet. And more recent buyers are having a tough time too, with a drop of 70% in the last year. Furthermore, it's down 20% in about a quarter. That's not much fun for holders. We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

Since China Resources Building Materials Technology Holdings has shed HK$489m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

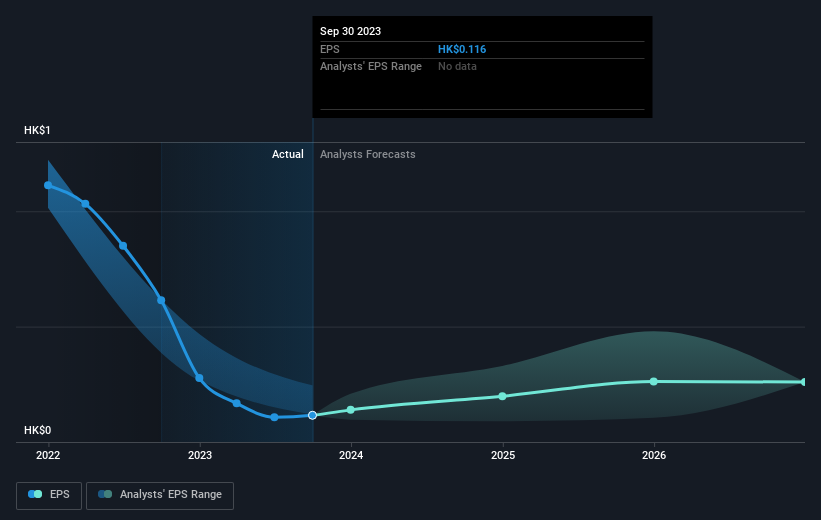

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the three years that the share price fell, China Resources Building Materials Technology Holdings' earnings per share (EPS) dropped by 57% each year. This change in EPS is reasonably close to the 48% average annual decrease in the share price. So it seems that investor expectations of the company are staying pretty steady, despite the disappointment. It seems like the share price is reflecting the declining earnings per share.

During the three years that the share price fell, China Resources Building Materials Technology Holdings' earnings per share (EPS) dropped by 57% each year. This change in EPS is reasonably close to the 48% average annual decrease in the share price. So it seems that investor expectations of the company are staying pretty steady, despite the disappointment. It seems like the share price is reflecting the declining earnings per share.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

SEHK:1313 Earnings Per Share Growth March 7th 2024

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, China Resources Building Materials Technology Holdings' TSR for the last 3 years was -84%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

We regret to report that China Resources Building Materials Technology Holdings shareholders are down 69% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 11%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 12% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that China Resources Building Materials Technology Holdings is showing 3 warning signs in our investment analysis , you should know about...

We will like China Resources Building Materials Technology Holdings better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.