JAKKS Pacific, Inc. (NASDAQ:JAKK) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. Looking at the bigger picture, even after this poor month the stock is up 58% in the last year.

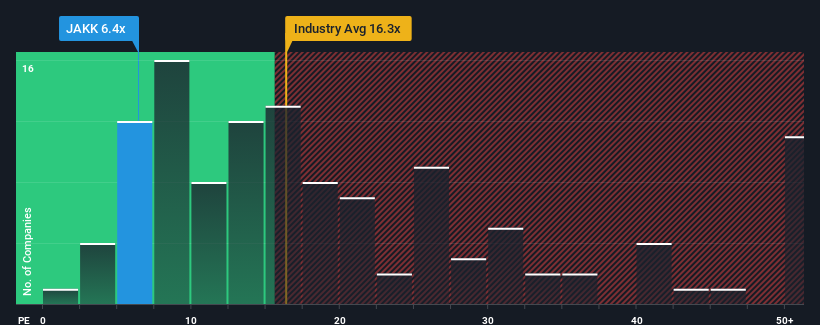

Although its price has dipped substantially, JAKKS Pacific's price-to-earnings (or "P/E") ratio of 6.4x might still make it look like a strong buy right now compared to the market in the United States, where around half of the companies have P/E ratios above 17x and even P/E's above 32x are quite common. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Recent times haven't been advantageous for JAKKS Pacific as its earnings have been falling quicker than most other companies. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

How Is JAKKS Pacific's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as depressed as JAKKS Pacific's is when the company's growth is on track to lag the market decidedly.

The only time you'd be truly comfortable seeing a P/E as depressed as JAKKS Pacific's is when the company's growth is on track to lag the market decidedly.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 60%. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the sole analyst covering the company suggest earnings should grow by 26% over the next year. With the market only predicted to deliver 12%, the company is positioned for a stronger earnings result.

In light of this, it's peculiar that JAKKS Pacific's P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From JAKKS Pacific's P/E?

Shares in JAKKS Pacific have plummeted and its P/E is now low enough to touch the ground. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that JAKKS Pacific currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for JAKKS Pacific that you should be aware of.

If you're unsure about the strength of JAKKS Pacific's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.