Those holding Shaanxi Lighte Optoelectronics Material Co.,Ltd (SHSE:688150) shares would be relieved that the share price has rebounded 27% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 24% over that time.

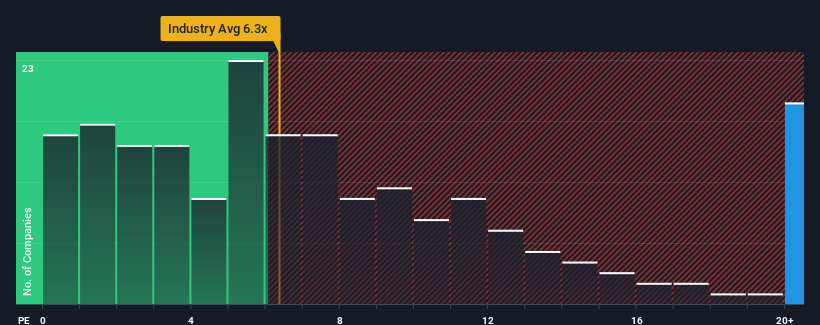

Since its price has surged higher, Shaanxi Lighte Optoelectronics MaterialLtd may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 25.2x, when you consider almost half of the companies in the Semiconductor industry in China have P/S ratios under 6.3x and even P/S lower than 3x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

What Does Shaanxi Lighte Optoelectronics MaterialLtd's P/S Mean For Shareholders?

Recent times haven't been great for Shaanxi Lighte Optoelectronics MaterialLtd as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. If not, then existing shareholders may be very nervous about the viability of the share price.

Keen to find out how analysts think Shaanxi Lighte Optoelectronics MaterialLtd's future stacks up against the industry? In that case, our free report is a great place to start.How Is Shaanxi Lighte Optoelectronics MaterialLtd's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Shaanxi Lighte Optoelectronics MaterialLtd's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a decent 7.3% gain to the company's revenues. The latest three year period has also seen a 9.5% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Looking ahead now, revenue is anticipated to climb by 80% during the coming year according to the three analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 37%, which is noticeably less attractive.

In light of this, it's understandable that Shaanxi Lighte Optoelectronics MaterialLtd's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Shaanxi Lighte Optoelectronics MaterialLtd's P/S?

Shaanxi Lighte Optoelectronics MaterialLtd's P/S has grown nicely over the last month thanks to a handy boost in the share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Shaanxi Lighte Optoelectronics MaterialLtd's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Shaanxi Lighte Optoelectronics MaterialLtd that you should be aware of.

If you're unsure about the strength of Shaanxi Lighte Optoelectronics MaterialLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.