The Great Harvest Maeta Holdings Limited (HKG:3683) share price has done very well over the last month, posting an excellent gain of 57%. Looking back a bit further, it's encouraging to see the stock is up 54% in the last year.

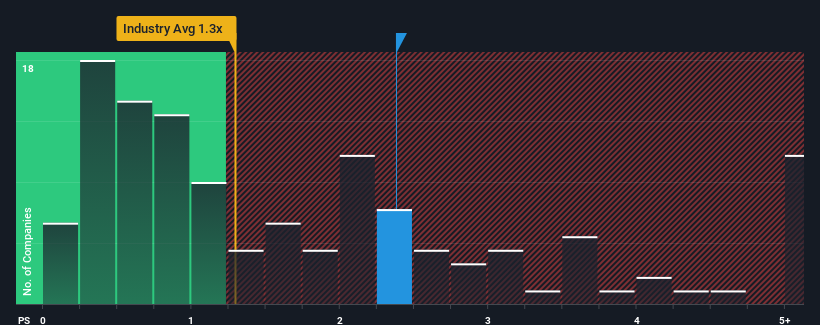

Following the firm bounce in price, you could be forgiven for thinking Great Harvest Maeta Holdings is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.4x, considering almost half the companies in Hong Kong's Shipping industry have P/S ratios below 0.8x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

How Great Harvest Maeta Holdings Has Been Performing

As an illustration, revenue has deteriorated at Great Harvest Maeta Holdings over the last year, which is not ideal at all. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Great Harvest Maeta Holdings will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Great Harvest Maeta Holdings would need to produce impressive growth in excess of the industry.

In order to justify its P/S ratio, Great Harvest Maeta Holdings would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered a frustrating 36% decrease to the company's top line. Even so, admirably revenue has lifted 31% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Comparing that to the industry, which is predicted to shrink 17% in the next 12 months, the company's positive momentum based on recent medium-term revenue results is a bright spot for the moment.

In light of this, it's understandable that Great Harvest Maeta Holdings' P/S sits above the majority of other companies. Investors are willing to pay more for a stock they hope will buck the trend of the broader industry going backwards. However, its current revenue trajectory will be very difficult to maintain against the headwinds other companies are facing at the moment.

The Final Word

Great Harvest Maeta Holdings' P/S is on the rise since its shares have risen strongly. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Great Harvest Maeta Holdings revealed its growing revenue over the medium-term is helping prop up its high P/S compared to its peers, given the industry is set to shrink. Right now shareholders are comfortable with the P/S as they are quite confident revenues aren't under threat. However, it'd be fair to raise concerns over whether this level of revenue performance will continue given the harsh conditions facing the industry. Although, if the company's relative performance doesn't change it will continue to provide strong support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Great Harvest Maeta Holdings (at least 1 which is potentially serious), and understanding these should be part of your investment process.

If you're unsure about the strength of Great Harvest Maeta Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.