We Think Huayi Brothers Media (SZSE:300027) Has A Fair Chunk Of Debt

We Think Huayi Brothers Media (SZSE:300027) Has A Fair Chunk Of Debt

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Huayi Brothers Media Corporation (SZSE:300027) does use debt in its business. But the more important question is: how much risk is that debt creating?

大卫·伊本说得好,他说:“波动性不是我们关心的风险。我们关心的是避免资本的永久损失。”因此,很明显,当你考虑任何给定股票的风险时,你需要考虑债务,因为过多的债务会使公司陷入困境。我们可以看到,华谊兄弟传媒公司(深圳证券交易所代码:300027)确实在其业务中使用了债务。但更重要的问题是:这笔债务会带来多大的风险?

What Risk Does Debt Bring?

债务会带来什么风险?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

债务是帮助企业增长的工具,但是如果企业无法偿还贷款人的债务,那么债务就会任由他们摆布。资本主义的重要组成部分是 “创造性破坏” 过程,在这种过程中,倒闭的企业被银行家无情地清算。但是,更常见(但仍然很痛苦)的情况是,它必须以低廉的价格筹集新的股权资本,从而永久稀释股东。当然,许多公司使用债务为增长提供资金,而不会产生任何负面影响。在考虑企业使用多少债务时,要做的第一件事就是综合考虑其现金和债务。

What Is Huayi Brothers Media's Debt?

华谊兄弟传媒的债务是多少?

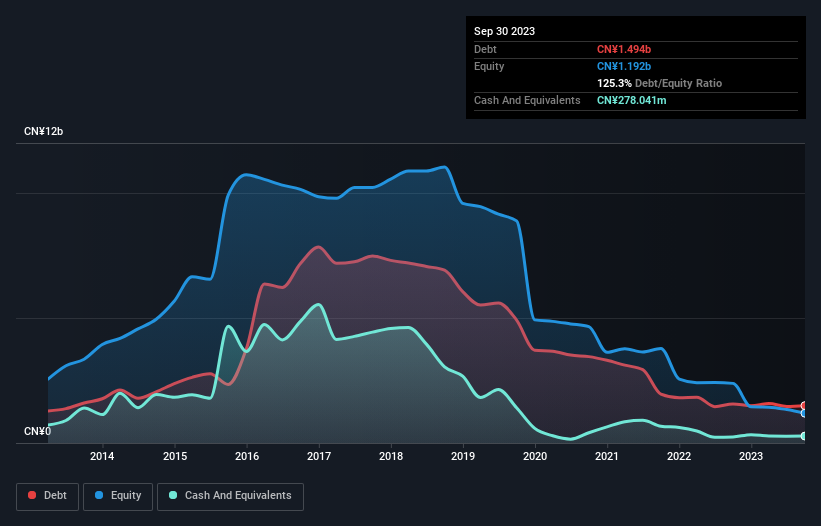

As you can see below, Huayi Brothers Media had CN¥1.49b of debt at September 2023, down from CN¥1.56b a year prior. However, it does have CN¥278.0m in cash offsetting this, leading to net debt of about CN¥1.22b.

如下所示,截至2023年9月,华谊兄弟传媒的债务为14.9亿元人民币,低于去年同期的15.6亿元人民币。但是,它确实有2.78亿元的现金抵消了这一点,净负债约为12.2亿元人民币。

A Look At Huayi Brothers Media's Liabilities

看看华谊兄弟传媒的负债

We can see from the most recent balance sheet that Huayi Brothers Media had liabilities of CN¥2.71b falling due within a year, and liabilities of CN¥975.4m due beyond that. On the other hand, it had cash of CN¥278.0m and CN¥280.4m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥3.13b.

我们可以从最新的资产负债表中看出,华谊兄弟传媒的负债为27.1亿元人民币,一年后到期的负债为9.754亿元人民币。另一方面,它有一年内到期的现金为2.78亿元人民币,还有价值2.804亿元人民币的应收账款。因此,其负债超过其现金和(短期)应收账款总额31.3亿元人民币。

Huayi Brothers Media has a market capitalization of CN¥6.33b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Huayi Brothers Media's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

华谊兄弟传媒的市值为63.3亿元人民币,因此,如果需要,它很可能会筹集资金以改善资产负债表。但是,仍然值得仔细研究其偿还债务的能力。资产负债表显然是分析债务时需要关注的领域。但是,未来的收益将决定华谊兄弟传媒未来维持健康资产负债表的能力。因此,如果你想看看专业人士的想法,你可能会发现这份关于分析师利润预测的免费报告很有趣。

In the last year Huayi Brothers Media had a loss before interest and tax, and actually shrunk its revenue by 37%, to CN¥513m. That makes us nervous, to say the least.

去年,华谊兄弟传媒在利息和税前出现亏损,实际收入减少了37%,至5.13亿元人民币。至少可以说,这让我们感到紧张。

Caveat Emptor

Caveat Emptor

Not only did Huayi Brothers Media's revenue slip over the last twelve months, but it also produced negative earnings before interest and tax (EBIT). To be specific the EBIT loss came in at CN¥464m. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. So we think its balance sheet is a little strained, though not beyond repair. For example, we would not want to see a repeat of last year's loss of CN¥1.0b. So to be blunt we do think it is risky. For riskier companies like Huayi Brothers Media I always like to keep an eye on the long term profit and revenue trends. Fortunately, you can click to see our interactive graph of its profit, revenue, and operating cashflow.

在过去的十二个月中,华谊兄弟传媒不仅收入下滑,而且还产生了负的息税前收益(EBIT)。具体而言,息税前利润亏损为4.64亿元人民币。考虑到除了上述负债外,我们对公司应该使用如此多的债务没有太大的信心。因此,我们认为其资产负债表有些紧张,尽管并非无法修复。例如,我们不希望看到去年10亿元人民币的亏损重演。因此,坦率地说,我们确实认为这是有风险的。对于像华谊兄弟传媒这样的风险较高的公司,我总是喜欢关注长期的利润和收入趋势。幸运的是,您可以点击查看我们的利润、收入和运营现金流的交互式图表。

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

毕竟,如果你对一家资产负债表坚如磐石的快速成长型公司更感兴趣,那么请立即查看我们的净现金增长股票清单。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧?直接联系我们。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St的这篇文章本质上是笼统的。我们仅使用公正的方法根据历史数据和分析师的预测提供评论,我们的文章无意作为财务建议。它不构成买入或卖出任何股票的建议,也没有考虑到您的目标或财务状况。我们的目标是为您提供由基本数据驱动的长期重点分析。请注意,我们的分析可能不考虑最新的价格敏感型公司公告或定性材料。简而言之,华尔街没有持有任何上述股票的头寸。

We can see from the most recent balance sheet that Huayi Brothers Media had liabilities of CN¥2.71b falling due within a year, and liabilities of CN¥975.4m due beyond that. On the other hand, it had cash of CN¥278.0m and CN¥280.4m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥3.13b.

We can see from the most recent balance sheet that Huayi Brothers Media had liabilities of CN¥2.71b falling due within a year, and liabilities of CN¥975.4m due beyond that. On the other hand, it had cash of CN¥278.0m and CN¥280.4m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥3.13b.