China Lesso Group Holdings Limited (HKG:2128) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 44% over that time.

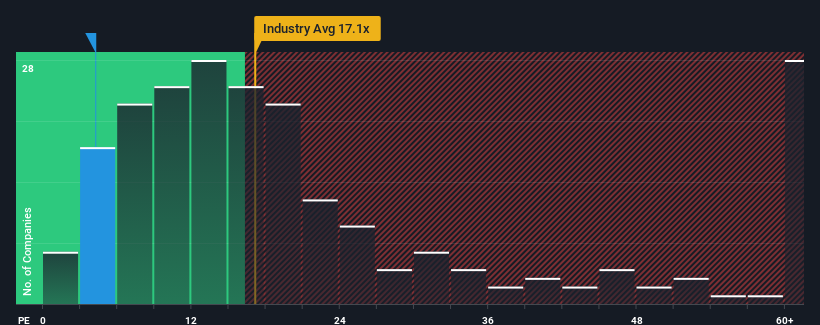

In spite of the firm bounce in price, China Lesso Group Holdings may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 4.2x, since almost half of all companies in Hong Kong have P/E ratios greater than 9x and even P/E's higher than 18x are not unusual. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

China Lesso Group Holdings certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Does Growth Match The Low P/E?

In order to justify its P/E ratio, China Lesso Group Holdings would need to produce anemic growth that's substantially trailing the market.

In order to justify its P/E ratio, China Lesso Group Holdings would need to produce anemic growth that's substantially trailing the market.

If we review the last year of earnings growth, the company posted a worthy increase of 7.4%. However, this wasn't enough as the latest three year period has seen an unpleasant 14% overall drop in EPS. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 11% per year during the coming three years according to the eight analysts following the company. That's shaping up to be materially lower than the 15% each year growth forecast for the broader market.

With this information, we can see why China Lesso Group Holdings is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From China Lesso Group Holdings' P/E?

China Lesso Group Holdings' recent share price jump still sees its P/E sitting firmly flat on the ground. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of China Lesso Group Holdings' analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for China Lesso Group Holdings that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.