It hasn't been the best quarter for Guangdong Jiaying Pharmaceutical Co., Ltd (SZSE:002198) shareholders, since the share price has fallen 11% in that time. But over three years, the returns would have left most investors smiling To wit, the share price did better than an index fund, climbing 32% during that period.

Since it's been a strong week for Guangdong Jiaying Pharmaceutical shareholders, let's have a look at trend of the longer term fundamentals.

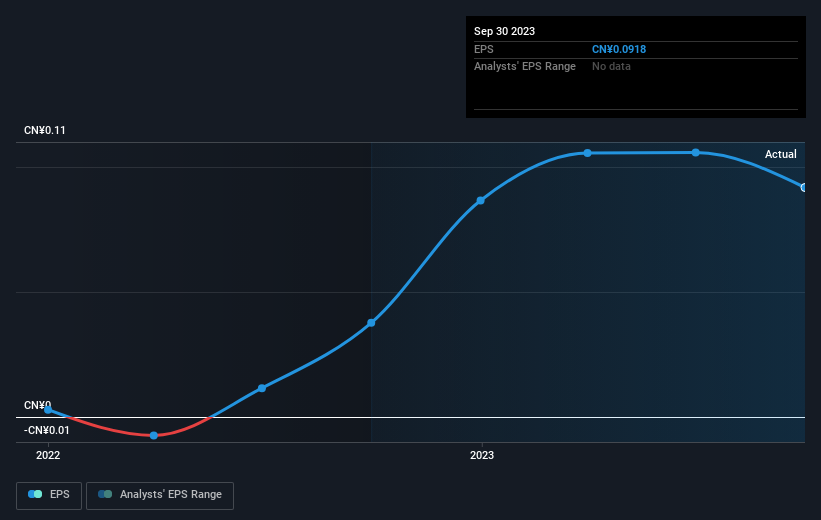

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Guangdong Jiaying Pharmaceutical became profitable within the last three years. So we would expect a higher share price over the period.

Guangdong Jiaying Pharmaceutical became profitable within the last three years. So we would expect a higher share price over the period.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Guangdong Jiaying Pharmaceutical's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Although it hurts that Guangdong Jiaying Pharmaceutical returned a loss of 9.9% in the last twelve months, the broader market was actually worse, returning a loss of 13%. Of course, the long term returns are far more important and the good news is that over five years, the stock has returned 0.3% for each year. In the best case scenario the last year is just a temporary blip on the journey to a brighter future. Is Guangdong Jiaying Pharmaceutical cheap compared to other companies? These 3 valuation measures might help you decide.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.