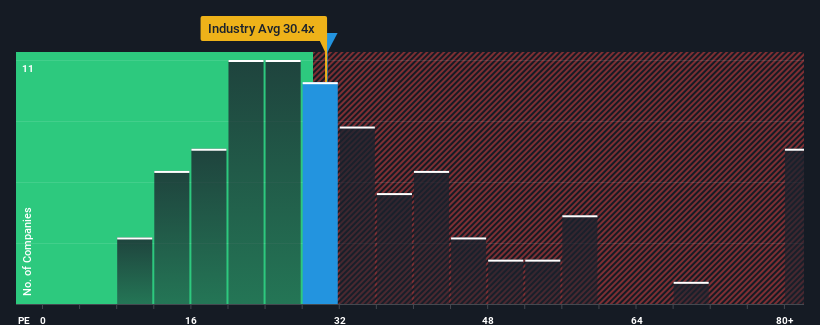

There wouldn't be many who think SWS Hemodialysis Care Co., Ltd.'s (SHSE:688410) price-to-earnings (or "P/E") ratio of 30.6x is worth a mention when the median P/E in China is similar at about 31x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Recent times have been quite advantageous for SWS Hemodialysis Care as its earnings have been rising very briskly. The P/E is probably moderate because investors think this strong earnings growth might not be enough to outperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Is There Some Growth For SWS Hemodialysis Care?

In order to justify its P/E ratio, SWS Hemodialysis Care would need to produce growth that's similar to the market.

Retrospectively, the last year delivered an exceptional 146% gain to the company's bottom line. Pleasingly, EPS has also lifted 540% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Retrospectively, the last year delivered an exceptional 146% gain to the company's bottom line. Pleasingly, EPS has also lifted 540% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 40% shows it's noticeably more attractive on an annualised basis.

In light of this, it's curious that SWS Hemodialysis Care's P/E sits in line with the majority of other companies. It may be that most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From SWS Hemodialysis Care's P/E?

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of SWS Hemodialysis Care revealed its three-year earnings trends aren't contributing to its P/E as much as we would have predicted, given they look better than current market expectations. There could be some unobserved threats to earnings preventing the P/E ratio from matching this positive performance. At least the risk of a price drop looks to be subdued if recent medium-term earnings trends continue, but investors seem to think future earnings could see some volatility.

Plus, you should also learn about this 1 warning sign we've spotted with SWS Hemodialysis Care.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.