To the annoyance of some shareholders, CStone Pharmaceuticals (HKG:2616) shares are down a considerable 34% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 73% share price decline.

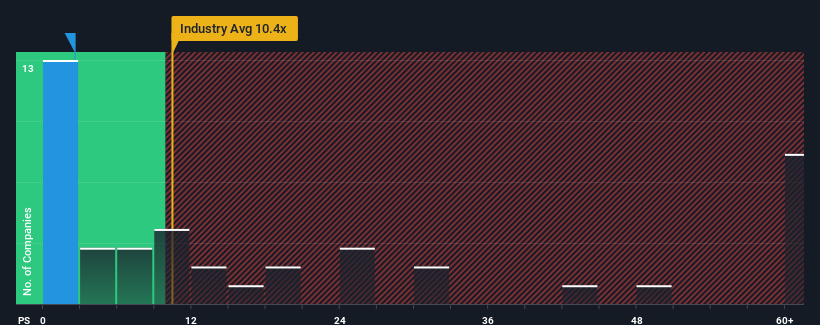

Since its price has dipped substantially, CStone Pharmaceuticals' price-to-sales (or "P/S") ratio of 2.6x might make it look like a strong buy right now compared to the wider Biotechs industry in Hong Kong, where around half of the companies have P/S ratios above 10.4x and even P/S above 30x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

What Does CStone Pharmaceuticals' Recent Performance Look Like?

Recent times haven't been great for CStone Pharmaceuticals as its revenue has been rising slower than most other companies. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on CStone Pharmaceuticals.How Is CStone Pharmaceuticals' Revenue Growth Trending?

CStone Pharmaceuticals' P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

CStone Pharmaceuticals' P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 13% last year. Although, the latest three year period in total hasn't been as good as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 60% over the next year. Meanwhile, the rest of the industry is forecast to expand by 82%, which is noticeably more attractive.

With this information, we can see why CStone Pharmaceuticals is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Shares in CStone Pharmaceuticals have plummeted and its P/S has followed suit. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of CStone Pharmaceuticals' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with CStone Pharmaceuticals, and understanding these should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.