Those holding Jiangsu Yunyong Electronics and Technology Co.,Ltd (SHSE:688060) shares would be relieved that the share price has rebounded 27% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 46% over that time.

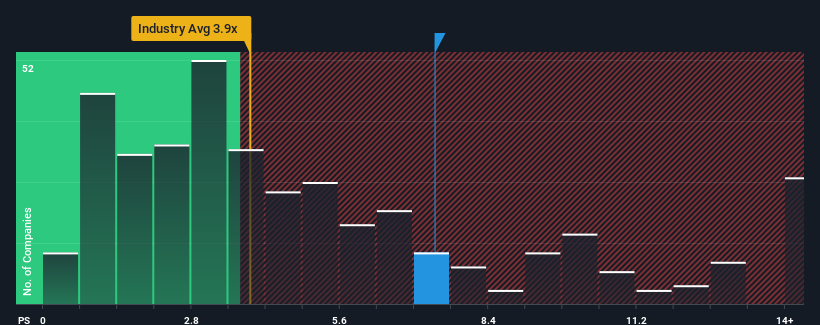

Following the firm bounce in price, given around half the companies in China's Electronic industry have price-to-sales ratios (or "P/S") below 3.9x, you may consider Jiangsu Yunyong Electronics and TechnologyLtd as a stock to avoid entirely with its 7.4x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

What Does Jiangsu Yunyong Electronics and TechnologyLtd's P/S Mean For Shareholders?

Recent times have been advantageous for Jiangsu Yunyong Electronics and TechnologyLtd as its revenues have been rising faster than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think Jiangsu Yunyong Electronics and TechnologyLtd's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Jiangsu Yunyong Electronics and TechnologyLtd's to be considered reasonable.

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Jiangsu Yunyong Electronics and TechnologyLtd's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 6.2% last year. The latest three year period has also seen a 7.4% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Looking ahead now, revenue is anticipated to climb by 163% during the coming year according to the one analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 25%, which is noticeably less attractive.

In light of this, it's understandable that Jiangsu Yunyong Electronics and TechnologyLtd's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Jiangsu Yunyong Electronics and TechnologyLtd's P/S

Jiangsu Yunyong Electronics and TechnologyLtd's P/S has grown nicely over the last month thanks to a handy boost in the share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look into Jiangsu Yunyong Electronics and TechnologyLtd shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Jiangsu Yunyong Electronics and TechnologyLtd with six simple checks.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.