Hubei Goto Biopharm Co.,Ltd. (SZSE:300966) shareholders are no doubt pleased to see that the share price has bounced 31% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 32% over that time.

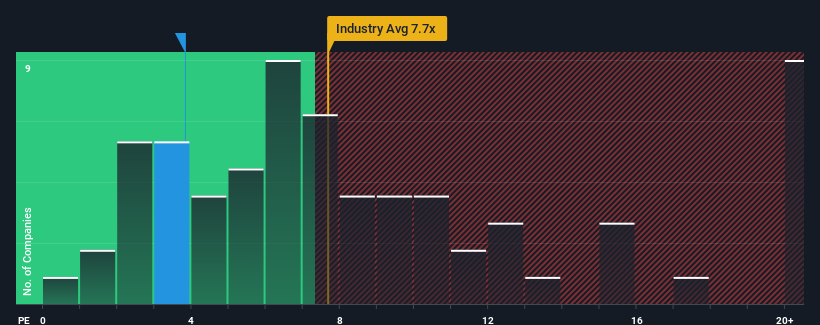

In spite of the firm bounce in price, Hubei Goto BiopharmLtd may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 3.8x, since almost half of all companies in the Biotechs industry in China have P/S ratios greater than 7.7x and even P/S higher than 13x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

How Has Hubei Goto BiopharmLtd Performed Recently?

For instance, Hubei Goto BiopharmLtd's receding revenue in recent times would have to be some food for thought. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Hubei Goto BiopharmLtd's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Hubei Goto BiopharmLtd's to be considered reasonable.

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Hubei Goto BiopharmLtd's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 8.3%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 16% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 182% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this in consideration, it's easy to understand why Hubei Goto BiopharmLtd's P/S falls short of the mark set by its industry peers. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

What We Can Learn From Hubei Goto BiopharmLtd's P/S?

Hubei Goto BiopharmLtd's recent share price jump still sees fails to bring its P/S alongside the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

In line with expectations, Hubei Goto BiopharmLtd maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

You need to take note of risks, for example - Hubei Goto BiopharmLtd has 5 warning signs (and 3 which are significant) we think you should know about.

If you're unsure about the strength of Hubei Goto BiopharmLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.