Those holding Baotou Huazi Industry Co., Ltd (SHSE:600191) shares would be relieved that the share price has rebounded 27% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 7.8% over the last year.

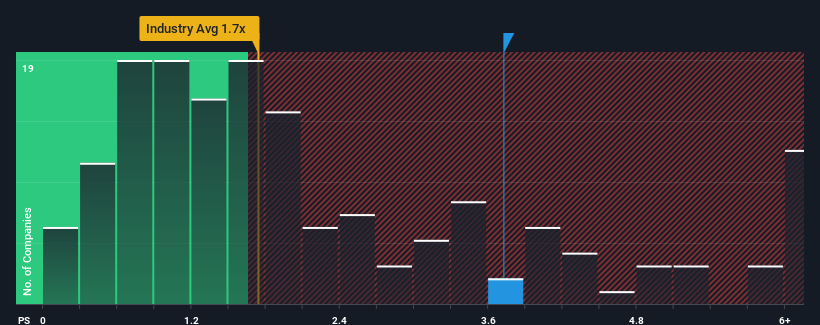

After such a large jump in price, when almost half of the companies in China's Food industry have price-to-sales ratios (or "P/S") below 1.7x, you may consider Baotou Huazi Industry as a stock probably not worth researching with its 3.7x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

What Does Baotou Huazi Industry's Recent Performance Look Like?

With revenue growth that's exceedingly strong of late, Baotou Huazi Industry has been doing very well. Perhaps the market is expecting future revenue performance to outperform the wider market, which has seemingly got people interested in the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Baotou Huazi Industry's earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Baotou Huazi Industry?

The only time you'd be truly comfortable seeing a P/S as high as Baotou Huazi Industry's is when the company's growth is on track to outshine the industry.

The only time you'd be truly comfortable seeing a P/S as high as Baotou Huazi Industry's is when the company's growth is on track to outshine the industry.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. Spectacularly, three year revenue growth has also set the world alight, thanks to the last 12 months of incredible growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that to the industry, which is only predicted to deliver 16% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

In light of this, it's understandable that Baotou Huazi Industry's P/S sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Key Takeaway

Baotou Huazi Industry shares have taken a big step in a northerly direction, but its P/S is elevated as a result. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It's no surprise that Baotou Huazi Industry can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Baotou Huazi Industry that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.