Shandong Kehui Power Automation Co.,Ltd. (SHSE:688681) shareholders are no doubt pleased to see that the share price has bounced 25% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 32% in the last twelve months.

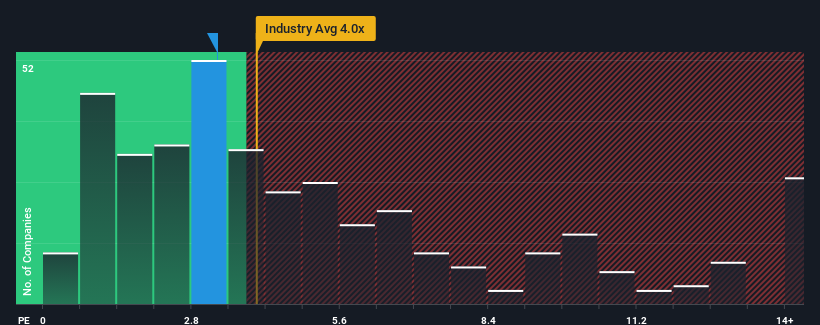

In spite of the firm bounce in price, it's still not a stretch to say that Shandong Kehui Power AutomationLtd's price-to-sales (or "P/S") ratio of 3.3x right now seems quite "middle-of-the-road" compared to the Electronic industry in China, where the median P/S ratio is around 4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

How Has Shandong Kehui Power AutomationLtd Performed Recently?

The revenue growth achieved at Shandong Kehui Power AutomationLtd over the last year would be more than acceptable for most companies. Perhaps the market is expecting future revenue performance to only keep up with the broader industry, which has keeping the P/S in line with expectations. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Shandong Kehui Power AutomationLtd's earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Shandong Kehui Power AutomationLtd's to be considered reasonable.

There's an inherent assumption that a company should be matching the industry for P/S ratios like Shandong Kehui Power AutomationLtd's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 11%. However, due to its less than impressive performance prior to this period, revenue growth is practically non-existent over the last three years overall. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Comparing that to the industry, which is predicted to deliver 25% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

In light of this, it's curious that Shandong Kehui Power AutomationLtd's P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What Does Shandong Kehui Power AutomationLtd's P/S Mean For Investors?

Shandong Kehui Power AutomationLtd appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Shandong Kehui Power AutomationLtd's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

You should always think about risks. Case in point, we've spotted 3 warning signs for Shandong Kehui Power AutomationLtd you should be aware of, and 2 of them shouldn't be ignored.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.