Huaiji Dengyun Auto-parts (Holding) Co.,Ltd. (SZSE:002715) shareholders are no doubt pleased to see that the share price has bounced 48% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 18% over that time.

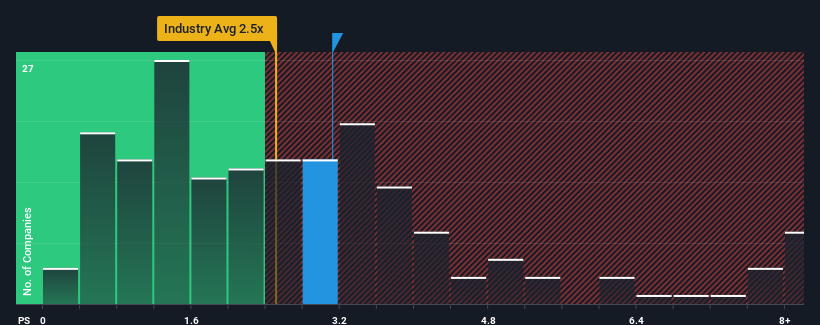

Following the firm bounce in price, when almost half of the companies in China's Auto Components industry have price-to-sales ratios (or "P/S") below 2.5x, you may consider Huaiji Dengyun Auto-parts (Holding)Ltd as a stock probably not worth researching with its 3.1x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

How Huaiji Dengyun Auto-parts (Holding)Ltd Has Been Performing

Revenue has risen firmly for Huaiji Dengyun Auto-parts (Holding)Ltd recently, which is pleasing to see. It might be that many expect the respectable revenue performance to beat most other companies over the coming period, which has increased investors' willingness to pay up for the stock. If not, then existing shareholders may be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Huaiji Dengyun Auto-parts (Holding)Ltd's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Huaiji Dengyun Auto-parts (Holding)Ltd's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 8.4%. The latest three year period has also seen an excellent 52% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 22% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's alarming that Huaiji Dengyun Auto-parts (Holding)Ltd's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What Does Huaiji Dengyun Auto-parts (Holding)Ltd's P/S Mean For Investors?

Huaiji Dengyun Auto-parts (Holding)Ltd shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

The fact that Huaiji Dengyun Auto-parts (Holding)Ltd currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. Right now we aren't comfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these the share price as being reasonable.

You should always think about risks. Case in point, we've spotted 2 warning signs for Huaiji Dengyun Auto-parts (Holding)Ltd you should be aware of, and 1 of them makes us a bit uncomfortable.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.