Those holding Guangdong Silver Age Sci & Tech Co.,Ltd. (SZSE:300221) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 7.6% over the last year.

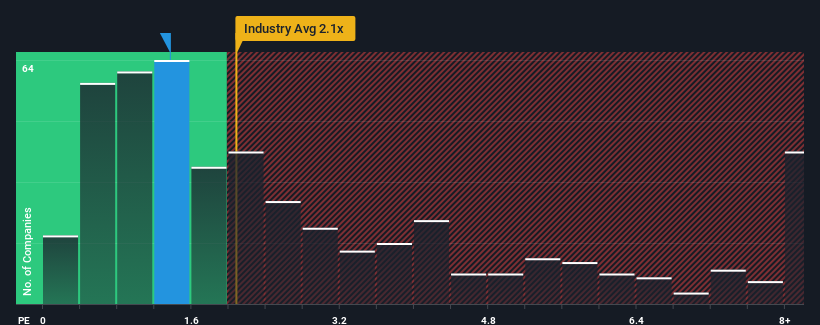

Even after such a large jump in price, Guangdong Silver Age Sci & TechLtd may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 1.4x, considering almost half of all companies in the Chemicals industry in China have P/S ratios greater than 2.1x and even P/S higher than 5x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

How Has Guangdong Silver Age Sci & TechLtd Performed Recently?

As an illustration, revenue has deteriorated at Guangdong Silver Age Sci & TechLtd over the last year, which is not ideal at all. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Although there are no analyst estimates available for Guangdong Silver Age Sci & TechLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as Guangdong Silver Age Sci & TechLtd's is when the company's growth is on track to lag the industry.

The only time you'd be truly comfortable seeing a P/S as low as Guangdong Silver Age Sci & TechLtd's is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 21%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 9.5% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 25% shows it's noticeably less attractive.

In light of this, it's understandable that Guangdong Silver Age Sci & TechLtd's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

The Bottom Line On Guangdong Silver Age Sci & TechLtd's P/S

Despite Guangdong Silver Age Sci & TechLtd's share price climbing recently, its P/S still lags most other companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Guangdong Silver Age Sci & TechLtd confirms that the company's revenue trends over the past three-year years are a key factor in its low price-to-sales ratio, as we suspected, given they fall short of current industry expectations. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Guangdong Silver Age Sci & TechLtd with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on Guangdong Silver Age Sci & TechLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.