1stdibs.Com, Inc. (NASDAQ:DIBS) shares have continued their recent momentum with a 26% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 51%.

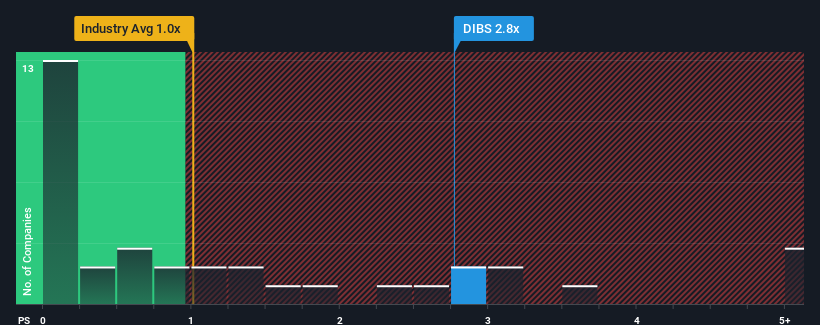

After such a large jump in price, when almost half of the companies in the United States' Multiline Retail industry have price-to-sales ratios (or "P/S") below 1x, you may consider 1stdibs.Com as a stock probably not worth researching with its 2.8x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

How Has 1stdibs.Com Performed Recently?

While the industry has experienced revenue growth lately, 1stdibs.Com's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on 1stdibs.Com.How Is 1stdibs.Com's Revenue Growth Trending?

In order to justify its P/S ratio, 1stdibs.Com would need to produce impressive growth in excess of the industry.

In order to justify its P/S ratio, 1stdibs.Com would need to produce impressive growth in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 13%. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 9.2% per year over the next three years. With the industry predicted to deliver 13% growth each year, the company is positioned for a weaker revenue result.

With this information, we find it concerning that 1stdibs.Com is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Bottom Line On 1stdibs.Com's P/S

1stdibs.Com shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It comes as a surprise to see 1stdibs.Com trade at such a high P/S given the revenue forecasts look less than stellar. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

It is also worth noting that we have found 1 warning sign for 1stdibs.Com that you need to take into consideration.

If these risks are making you reconsider your opinion on 1stdibs.Com, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.