Those holding SEP Analytical (Shanghai) Co., Ltd. (SZSE:301228) shares would be relieved that the share price has rebounded 41% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 31% in the last twelve months.

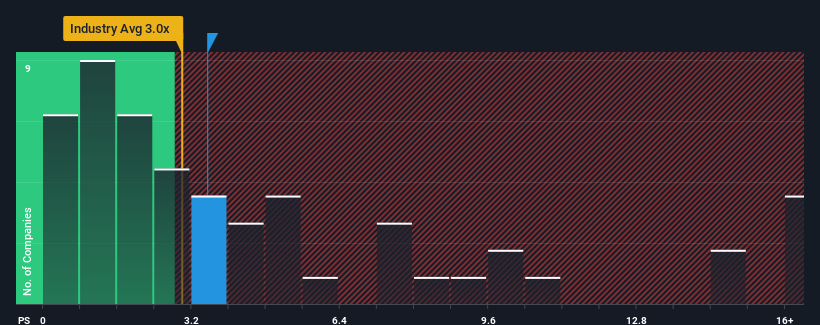

In spite of the firm bounce in price, it's still not a stretch to say that SEP Analytical (Shanghai)'s price-to-sales (or "P/S") ratio of 3.5x right now seems quite "middle-of-the-road" compared to the Professional Services industry in China, where the median P/S ratio is around 3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

What Does SEP Analytical (Shanghai)'s P/S Mean For Shareholders?

Revenue has risen at a steady rate over the last year for SEP Analytical (Shanghai), which is generally not a bad outcome. It might be that many expect the respectable revenue performance to only match most other companies over the coming period, which has kept the P/S from rising. If not, then at least existing shareholders probably aren't too pessimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on SEP Analytical (Shanghai)'s earnings, revenue and cash flow.How Is SEP Analytical (Shanghai)'s Revenue Growth Trending?

In order to justify its P/S ratio, SEP Analytical (Shanghai) would need to produce growth that's similar to the industry.

In order to justify its P/S ratio, SEP Analytical (Shanghai) would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 5.5% last year. The solid recent performance means it was also able to grow revenue by 8.6% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 95% shows it's noticeably less attractive.

With this information, we find it interesting that SEP Analytical (Shanghai) is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

The Final Word

Its shares have lifted substantially and now SEP Analytical (Shanghai)'s P/S is back within range of the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of SEP Analytical (Shanghai) revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. If recent medium-term revenue trends continue, the probability of a share price decline will become quite substantial, placing shareholders at risk.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for SEP Analytical (Shanghai) that you should be aware of.

If you're unsure about the strength of SEP Analytical (Shanghai)'s business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.