Ningbo Shenglong Automotive Powertrain System Co.,Ltd. (SHSE:603178) shareholders are no doubt pleased to see that the share price has bounced 40% in the last month, although it is still struggling to make up recently lost ground. The last month tops off a massive increase of 276% in the last year.

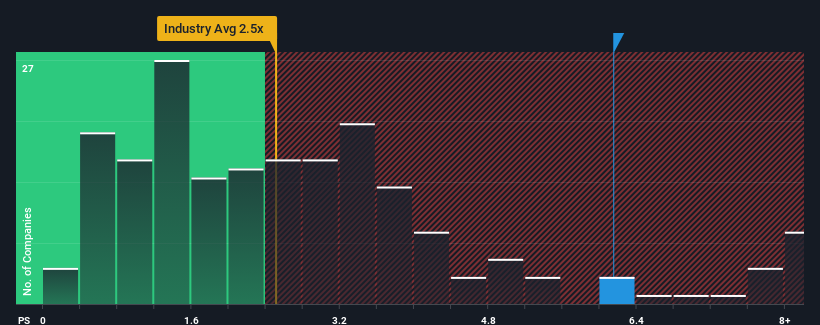

Since its price has surged higher, given around half the companies in China's Auto Components industry have price-to-sales ratios (or "P/S") below 2.5x, you may consider Ningbo Shenglong Automotive Powertrain SystemLtd as a stock to avoid entirely with its 6.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

How Ningbo Shenglong Automotive Powertrain SystemLtd Has Been Performing

Ningbo Shenglong Automotive Powertrain SystemLtd hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Ningbo Shenglong Automotive Powertrain SystemLtd.How Is Ningbo Shenglong Automotive Powertrain SystemLtd's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Ningbo Shenglong Automotive Powertrain SystemLtd's to be considered reasonable.

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Ningbo Shenglong Automotive Powertrain SystemLtd's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 6.5%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 17% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 38% during the coming year according to the lone analyst following the company. With the industry only predicted to deliver 22%, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Ningbo Shenglong Automotive Powertrain SystemLtd's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Ningbo Shenglong Automotive Powertrain SystemLtd's P/S

Ningbo Shenglong Automotive Powertrain SystemLtd's P/S has grown nicely over the last month thanks to a handy boost in the share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look into Ningbo Shenglong Automotive Powertrain SystemLtd shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

You should always think about risks. Case in point, we've spotted 3 warning signs for Ningbo Shenglong Automotive Powertrain SystemLtd you should be aware of, and 1 of them is a bit concerning.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.