Those holding Suzhou Delphi Laser Co., Ltd. (SHSE:688170) shares would be relieved that the share price has rebounded 27% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 33% in the last twelve months.

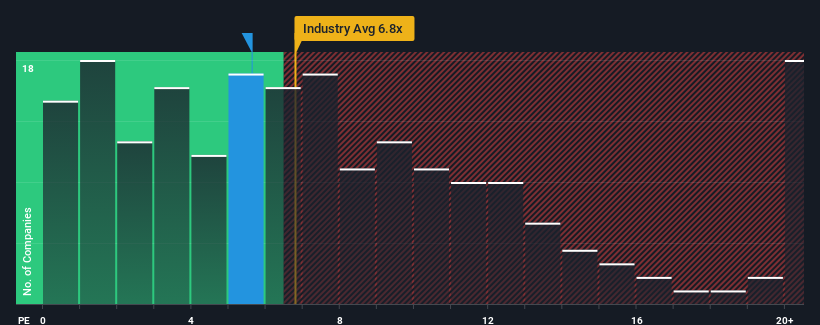

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Suzhou Delphi Laser's P/S ratio of 5.6x, since the median price-to-sales (or "P/S") ratio for the Semiconductor industry in China is also close to 6.8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

What Does Suzhou Delphi Laser's P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, Suzhou Delphi Laser has been relatively sluggish. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Suzhou Delphi Laser will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Suzhou Delphi Laser?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Suzhou Delphi Laser's to be considered reasonable.

There's an inherent assumption that a company should be matching the industry for P/S ratios like Suzhou Delphi Laser's to be considered reasonable.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Still, the latest three year period has seen an excellent 39% overall rise in revenue, in spite of its uninspiring short-term performance. Therefore, it's fair to say the revenue growth recently has been great for the company, but investors will want to ask why it has slowed to such an extent.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 25% over the next year. Meanwhile, the rest of the industry is forecast to expand by 34%, which is noticeably more attractive.

With this information, we find it interesting that Suzhou Delphi Laser is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What We Can Learn From Suzhou Delphi Laser's P/S?

Suzhou Delphi Laser appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

When you consider that Suzhou Delphi Laser's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

You should always think about risks. Case in point, we've spotted 2 warning signs for Suzhou Delphi Laser you should be aware of.

If you're unsure about the strength of Suzhou Delphi Laser's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.