Then play music, then dance

It's finally here!

This morning, the Bank of Japan officially announced the cancellation of the YCC policy and raised the benchmark interest rate from -0.1% to 0-0.1%.

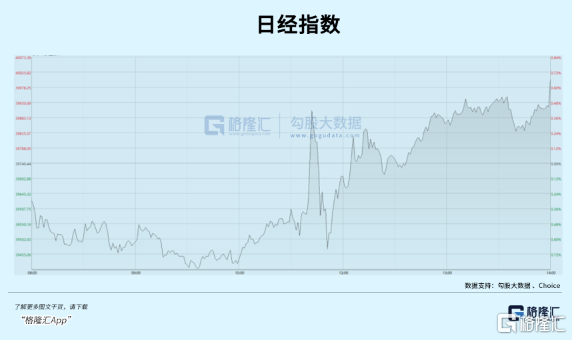

After the news came out, it caused a brief panic. The Nikkei index dived for 8 minutes, then immediately rose again.

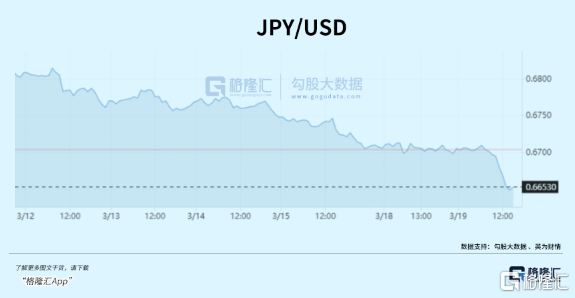

There was no hesitation in the yen exchange rate; the dollar rose more than 1 point against the yen in just 5 hours.

This shows that the market had anticipated this for a long time.

After experiencing a panic correction last week, the logic of yen depreciation, asset discounts, and Japanese stocks rising has not changed.

Japan's interest rate hike this time has only strengthened this logic.

01

Where did all the yen go?

The yen is a very special currency.

In fact, I've written an article before predicting that after the Bank of Japan raises interest rates, not only will the yen not appreciate, but it may depreciate faster.

Immediately after that, it triggered a chain reaction. Japanese assets continued to be “discounted,” and the Japanese stock market became more and more undervalued and continued to rise.

At the time, many people thought I was talking nonsense; now the facts speak louder than words.

Let's talk more deeply this time.

For the last 20 years, Japan has been frantically printing money, and interest rates have remained extremely low.

It's not surprising. Other economies are also printing large amounts of money, and the total amount of money is soaring.

One of the most important purposes is to raise the inflation rate and avoid falling into vicious deflation.

Strangely enough, prices have clearly risen when Chinese, American, and European banknotes are printed; in Japan alone, prices have remained largely unchanged.

According to the simplest mathematical logic: commodity price = amount of money/quantity of goods.

The population of Japan has not changed much over the years, so it can be assumed that the number of products has remained basically the same.

Since commodity prices have not changed, it can only be explained that the total amount of money circulating in Japanese society has basically not changed.

So where did all this yen that has been printed over the years go?

The stock market is only a relatively small aspect.

Foreign exchange and investing in overseas assets are the largest of the big ones.

Let's focus on forex trading first.

Foreign exchange is the largest financial market in the world. In 2023, the global average daily foreign exchange transaction volume was 6.6 trillion US dollars, which is tens of times more than the global stock market combined.

The Tokyo Foreign Exchange Market is the largest foreign exchange market in the world, and it is also an intangible market.

There are five categories of participants: the first is a bank specializing in foreign exchange, or the Bank of Tokyo; the second is a bank designated for foreign exchange, which includes more than 340 banks, including 243 domestic banks and 99 foreign banks; three are foreign exchange brokers; four are the Bank of Japan; and five are non-bank customers, mainly corporate entities, import and export companies, life and property insurance companies, investment trusts, trust banks, etc.

The main reason why it can be on such a large scale is that all people can participate.

Japan is a country where all people speculate on foreign exchange.

The Japanese foreign exchange market has created 35%-40% of the world's retail foreign exchange trading volume, and is an oversized container that can hold unlimited yen.

This is an alternative market where retail investors can call for ups and downs.

For example, the most famous Mrs. Watanabe refers to housewives who are in charge of the family's finances. They just desperately lent yen through zero interest rates or even negative interest rates, and then use this money to buy other high-interest currencies (especially dollars) to complete arbitrage.

According to the Bank of Japan's fund cycle data survey, Japanese household capital investment in foreign exchange accounts for 63% of the combined settlement of yen and foreign currency, which is far superior to financial institutions.

This phenomenon has continued for more than ten years, and retail investors in the Japanese foreign exchange market have actually become the main force in the global foreign exchange market.

Several major domestic online brokers, such as DMM Securities, GMO Click, and Invast Securities, can each have a monthly trading volume of over $1 trillion.

Mysterious organization in the foreign exchange market: Mrs. Watanabe

Mysterious organization in the foreign exchange market: Mrs. Watanabe

With such a simple lay back and profit model and such a huge arbitrage pool, it is obvious what will happen once the yen raises interest rates.

Interest spreads between yen and other currencies become smaller, especially after the US dollar enters the interest rate cut cycle, which will directly make it difficult for Mrs. Watanabe to continue to make money. Their enthusiasm for borrowing yen will drop drastically, and they will even be the first to return the yen to the bank.

Soon after, the amount of yen in the Bank of Japan's hands will rapidly increase at an unimaginable rate.

Therefore, after the interest rate hike, not only will the yen not appreciate, but it may depreciate even faster.

Even, that's not all.

The huge capital pool that has been broken through is not just the foreign exchange market.

02

Another huge pool

The money printed by the Bank of Japan is not just arbitrage for housewives.

It's just a benefit for citizens.

More importantly, the assets Japan has accumulated overseas over the years are already a frightening figure.

Everyone knows that after the Plaza Accord, the yen appreciated like crazy.

Judging from the perspective at the time, the Japanese didn't think there was anything wrong with this; they just felt very happy.

Japanese people are suddenly unprecedentedly wealthy. With countless amounts of real money in their hands, they don't know how to spend it. They can only frantically burn money and buy everywhere. The scale of Japan's foreign investment quickly rose to the top in the world.

But they bought in the wrong direction. Money is being wasted so meaninglessly that it's not being used in the right place.

Back then, a large amount of Japanese capital was withdrawn from industry and invested in the financial and real estate industries.

Now we all know this is called hollowing out.

Looking at Japan's foreign investment ratio back then, the vast majority of capital was used to invest in US real estate, but the Asian region where manufacturing was transferred was treated coldly.

From 1985 to 1990, Japanese companies carried out a total of 21 large-scale overseas mergers and acquisitions of 50 billion yen or more. Of these, 18 were US companies.

Japan bought 10% of America's real estate at the time and claimed to buy the entire US. Of course, these deals all went to waste in the end.

This incident is still a sign that the Japanese economy has reached its peak, making the Japanese people feel very refreshed.

After the bubble economy burst, as the Japanese stock market entered a 20-year bear market, Japanese investment channels declined sharply at home, and they were only able to continue to invest overseas.

From 1996 to 2022, the scale of Japan's foreign investment doubled 8 times, becoming “the world's largest net foreign asset country” for 32 consecutive years, and as a result, there is talk of “reinventing Japan overseas.”

All Japanese people are frantically borrowing money, using the opportunity of free exchange of local currency to allocate assets globally through overseas stock and foreign exchange transactions to hedge against the risk of shrinking domestic assets.

The so-called 30 years lost are actually also the 30 years where Japanese people made a lot of money overseas.

This set of operations not only protected the basic domestic economy, but also helped Japan get through the entire deflation cycle smoothly.

Overseas investments are still continuing, but this is not the same way of buying as before.

Japanese people aren't stupid either; they've been familiar with it for a long time.

Instead of focusing only on US real estate and finance, they are focusing more on developing countries' core assets.

This change was particularly evident after China joined the WTO.

Looking back, you can see that in the past 20 years, a large number of Japanese companies have invested in China. In the past two years, they have all left the country again.

According to data from Japan's Ministry of Finance, by the end of 2022, Japan's net overseas assets reached 2.82 trillion US dollars, and the actual total overseas assets were around 10 trillion US dollars.

Total overseas net assets have been rising for 5 consecutive years, ranking as the world's largest creditor country for 32 consecutive years.

Huge net assets overseas mean a higher level of monetary security, making the yen an internationally recognized “safe haven asset.”

When there are better investment opportunities outside of Japan, international capital borrows a large amount of yen and then converts investment income into assets such as dollars and euros; when unpredictable risk events occur in local regions, the reverse operation is carried out, exchanging foreign exchange for yen.

This kind of low-risk arbitrage has been repeated many times in modern history. From the subprime mortgage crisis to the European debt crisis to the huge shock caused by Brexit, international capital is pouring into Japan.

For example, Buffett borrowed almost all of his money to buy Japanese stocks.

Similar to the nature of the foreign exchange market, after the yen raises interest rates, it is difficult to maintain its current situation overseas, and a large amount of yen will flow back from the international market to the domestic market.

Coupled with the large amount of currency in the foreign exchange market, the large number of banknotes printed over the past few years will return to Japanese society at an unprecedented speed.

Liquidity within Japan suddenly increases, and prices will immediately rise at an accelerated pace, and currency depreciation will accelerate.

For the Japanese government, the cost of holding Japanese yen debt will actually decrease, which is equivalent to losing part of the account.

But for the Japanese people, how can they face a cycle of rising prices that they haven't experienced in decades?

03

Epilogue

Whether it was cutting interest rates many years ago or raising interest rates now, the Bank of Japan's purpose has probably never changed: depreciate the yen.

The benefits of currency depreciation far outweigh the disadvantages for the Japanese economy as a whole.

According to estimates by Japan's Daiwa Securities, for every 1 yen depreciation of the yen against the US dollar, the profits of all companies listed on the Tokyo Stock Market will increase by 1980 billion yen.

For example, for every 1 yen depreciation of the yen against the US dollar, Toyota's profit increases by about 48 billion yen, Honda's profit by about 10 billion yen, and Uniqlo's profit by about 1.2 billion yen...

This still doesn't take into account the calculation results of any variables.

The cheaper the yen, the cheaper the Japanese goods. Sales volume will inevitably increase, and the actual profit figure is bound to be far higher than the estimated value.

It's more than that.

After the depreciation of the yen, Japanese land, real estate, and any asset in Japanese yen became cheaper.

Why was the Japanese stock market so favored by foreign investors in the past? That's the logic.

Now, after Japan raised interest rates, the currency depreciated rapidly in a short period of time, which reinforces this logic.

Of course, this comes at a cost.

The depreciation of the yen and the increase in liquidity will inevitably raise the cost of living for citizens and affect people's livelihood.

However, these can only be considered a scabies disease; there is no need to solve them at the source; there are many alternatives.

For example, send money directly.

Since last year, the Japanese government has been asking domestic companies to raise their salaries drastically.

On March 15, the Japan Federation of Trade Unions announced that the response from companies to trade union wage increase requests was an average monthly salary increase of 16,469 yen, a salary increase of 5.28%, far exceeding 3.8% last year.

This is also the biggest increase since 1991.

At the same time, energy subsidy policies have also been implemented, such as a 42 yen subsidy for each liter of gasoline and a subsidy for each household's electricity bill.

These measures are all aimed at hedging the negative impact of the depreciation of the yen on residents' lives.

Obviously, the temptation to reduce debt pressure and promote economic growth is too great; the cost is nothing more than a “local” exchange rate.

It's a poison pill, but at least it's sweet right now. (End of full text)