Unfortunately for some shareholders, the Paranovus Entertainment Technology Ltd. (NASDAQ:PAVS) share price has dived 26% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 62% loss during that time.

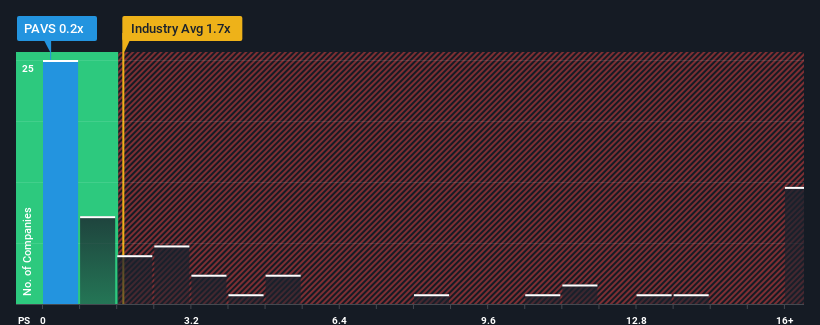

Following the heavy fall in price, Paranovus Entertainment Technology may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.2x, since almost half of all companies in the Personal Products industry in the United States have P/S ratios greater than 1.7x and even P/S higher than 5x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

How Has Paranovus Entertainment Technology Performed Recently?

Paranovus Entertainment Technology certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. Perhaps the market is expecting future revenue performance to dwindle, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Paranovus Entertainment Technology will help you shine a light on its historical performance.Do Revenue Forecasts Match The Low P/S Ratio?

Paranovus Entertainment Technology's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Paranovus Entertainment Technology's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 47%. The latest three year period has also seen an excellent 58% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 8.4%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's peculiar that Paranovus Entertainment Technology's P/S sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What Does Paranovus Entertainment Technology's P/S Mean For Investors?

Paranovus Entertainment Technology's recently weak share price has pulled its P/S back below other Personal Products companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Paranovus Entertainment Technology revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. When we see robust revenue growth that outpaces the industry, we presume that there are notable underlying risks to the company's future performance, which is exerting downward pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

You should always think about risks. Case in point, we've spotted 4 warning signs for Paranovus Entertainment Technology you should be aware of, and 2 of them are significant.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.